Market backdrop and crypto highlights of 2023

The global economy and heightened geopolitical uncertainty continue to present a very challenging macro backdrop. While headline numbers have been remarkably strong, there are real seismic movements under the surface that render the economic structure less stable. The U.S. economy grew 4.9% q/q annualized in 3Q (8.5% nominal) while the Fed hiked rates to the highest levels in a decade to 5.25%. The Federal Reserve has consistently aimed to strike a balance between managing inflation and fostering economic growth. However, at this point, they are juggling multiple complex challenges with diminished control and limited flexibility.

Additionally, as recently as Friday November 10th, Moody’s lowered its ratings outlook on the United States’ government to negative from stable, pointing to rising risks to the nation’s fiscal strength, citing: “the U.S.’ fiscal deficits will remain very large, significantly weakening debt affordability.”

Despite this difficult macro backdrop, crypto assets have shown strong performance this year (most notably Bitcoin, +129% YTD and +40% QTD as of Nov 15th). This is, in our opinion, driven by a combination of factors, including:

-

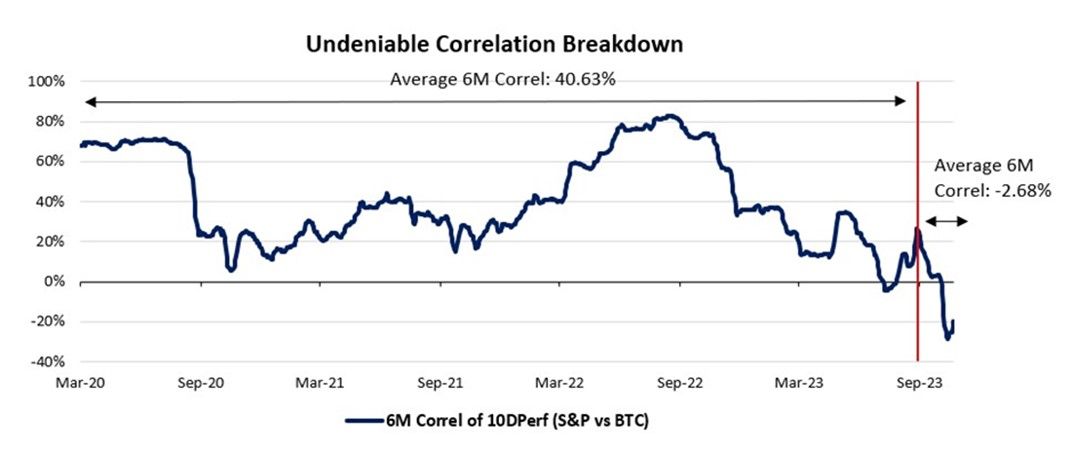

A regained interest in Bitcoin as a safe haven in the midst of a possible looming sovereign debt crisis. Correlations between crypto and other risk assets have decreased significantly. For example, since peaking ~80% in Sept ‘22, the correlation between BTC and the S&P 500 has remained under 40% all year (in line with the longer-term average) and turned meaningfully negative this quarter (see chart below).

-

The vote of confidence provided by some of the largest asset managers globally, including Blackrock, Fidelity, and Invesco (and their senior executives), as they prepare to launch their much-anticipated Bitcoin spot ETFs. This is expected to open the way for renewed and substantial inflows of institutional capital to the asset class.

-

Very light investor positioning in the asset class, as both institutional and broader retail investors have essentially ignored the space since the FTX debacle one year ago

Source: Bloomberg, CoinGecko

Source: Bloomberg, CoinGecko

These drivers are leading to a revival of activity in the space. We have seen not only prices soar, but also trading volumes finally rebound after having spent Q2 and Q3 at very depressed levels (70% below 2021). Combined with the next Bitcoin halving expected in April 2024 and tangible developments at the technology and application levels (that we discuss below), the asset class seems primed for a sustained increase in trading volumes and strong price trends.

Importantly, the industry is better prepared for the potential next wave of institutional capital inflows, as the ecosystem continues to learn and strengthen following the FTX debacle. For example, we are finally seeing real momentum towards broader adoption of off-exchange settlement. Many exchanges, including some of the largest like OKX, have secured agreements with various custodians such as Copper, as well as custodians with strong institutional backing such as Komainu (with Nomura) and Zodia (with Standard Chartered). These are key developments that allow for the separation between counterparties of trading on exchange while keeping collateral with the regulated custodian. There is still room for improvement, and not all exchanges are yet set up with such models, but this evolution is key to increasing trust within the industry. Furthermore, it appears that behind the scenes many of the U.S. and global banks are building more familiar TradFi capabilities for digital assets, to be ready once the regulatory framework is more settled.

Regulation has perhaps the most critical role to play in increasing trust in the system. The events of 2022 have certainly given regulators globally a greater sense of urgency. Jurisdictions with clearer regulatory frameworks for digital assets and the underlying technologies (e.g., Switzerland, the UK, the UAE, Hong Kong, and Singapore) have fostered innovation and continue to benefit from an influx of technical and entrepreneurial talent. Meanwhile, the approach from U.S. regulators continues to frustrate, centering more on enforcement than constructive dialogue, and has motivated many companies to look overseas for clearer guidance.

Continued adoption, innovation and applications of the underlying technology

New technologies often face periods of immense hype followed by disillusionment. The internet, machine learning, and AI were all too often referred to as “a solution looking for a problem”. Blockchain is no different. Despite these cycles, what has remained consistent is the steady technical development, proven real-world use cases, and resounding user adoption in an increasingly mature and consolidated ecosystem. Every transformative technology took many years (if not decades) of foundational work and development before broad public uptake. It's a consistent pattern of steady groundwork followed by rapid, explosive growth and acceptance, the precise timing of which is hard to predict.

We have observed significant developments at the infrastructure level of blockchain in several key areas. These include scalability improvements to increase the throughput of the underlying blockchains, selective privacy enabled by zero-knowledge cryptography that would prevent sensitive transactions from being visible in the public domain, and UX improvements enabled by account abstraction. Ethereum scaling solutions (Layer 2s) dramatically increase the transaction throughput of the network and enable new use cases and applications to be built for a fraction of the cost. These solutions have experienced significant adoption and growth over the past year with transaction volumes up almost 3-fold (from an average of 16 transactions per second (“TPS”) to 53 TPS) and Total Value Locked (“TVL”) up 140% ($5 billion to $12 billion) vs November 2022.

It is also evident that decentralized exchanges and stablecoins have found product-market fit, with an ever-growing universe of tokenized assets being issued and traded on-chain and traditional financial institutions using the code developed by DeFi protocols. This year has seen several large corporations actively integrate blockchain technology into their processes. A primary focus has been on developing payment or settlement layers, leveraging the efficiency and strong finality guarantees of blockchain technology. To illustrate:

-

JP Morgan processes millions of dollars in repo transactions daily on the Ethereum network

-

Similarly, both PayPal and Visa are establishing payment networks using the Ethereum and Solana blockchains to accelerate, facilitate, and reduce the cost of payment processing

-

Earlier this year, Franklin Templeton brought to market the first U.S-registered mutual fund to use a public blockchain to process transactions and record share ownership and has subsequently expanded to other public blockchains.

Real-world applications of blockchain technology such as these lay the groundwork for future growth in on-chain transactions.

Tokenization and payment infrastructure are just two of the very first large-scale applications of blockchain, and it is worth looking ahead and beyond financial applications. One area where we see blockchain technology having significant impact is at the intersection with artificial intelligence. AI, with its powerful capabilities and transformative potential, is often met with criticisms over the transparency and integrity of its processes and data inputs. Blockchains, valued for their immutability and transparent ledger system, offer a potential solution to these challenges. The synergies between these seemingly unrelated technologies not only enhances the reliability and accountability of AI systems, but also opens up new avenues for innovation, where decisions made by AI are verifiable and data sources are credible, leading to more robust, ethical, and efficient solutions.

As we reach the 2 year anniversary of peak euphoria and prices in crypto markets and 1 year since the fall of FTX, momentum in the crypto space seems to slowly be turning as the industry has learnt important lessons, made important adjustments and carries on driven by the ongoing innovation. The recent news about Binance looking to clean the slate and move forward under tighter supervision from the DOJ is another encouraging sign of a maturing ecosystem where to survive, all players need to adapt and institutionalize. We are encouraged by all these signs and the prospects they represent for the broader asset class.