An evolving opportunity in a maturing market

Blockchain is not new. Bitcoin is over 14 years old and Ethereum was initially conceived a decade ago. The underlying technology has been continuously evolving and now consists of a broad range of use cases at various stages of growth and innovation. This has led to the issuance of many new tokens, many of which are still in their infancy and differ in the rights and financial exposure they provide to the underlying technology. However, this constant pace of innovation has significantly broadened the investment opportunity across a number of dimensions over the past decade.

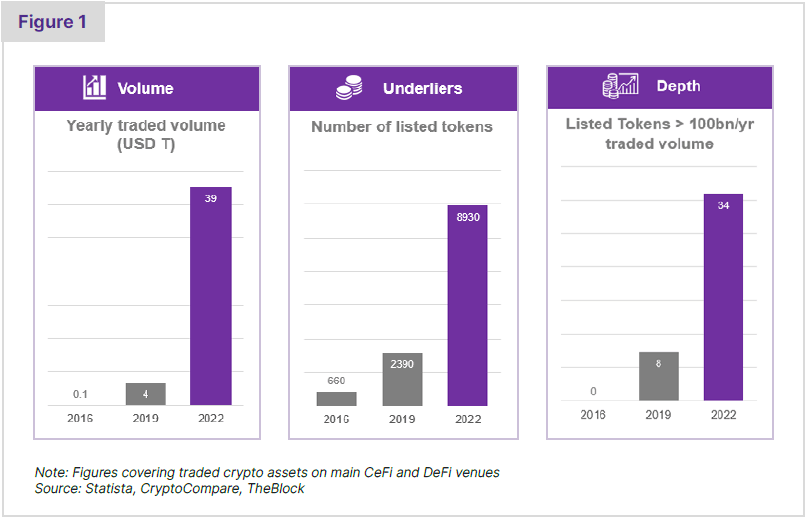

Depth - Over $1T market cap with a growing set of derivative products and improved market liquidity from the participation of institutional liquidity providers (see Figure 1).

Breadth - 20,000 tokens, about half of which are listed and over 200 with a market capitalization above $100M. 34 tokens traded over $100B in 2022.

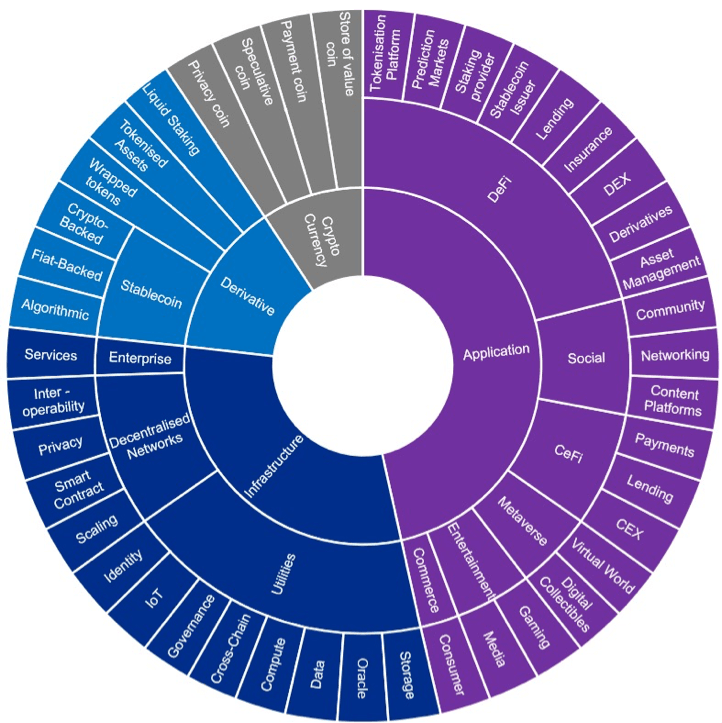

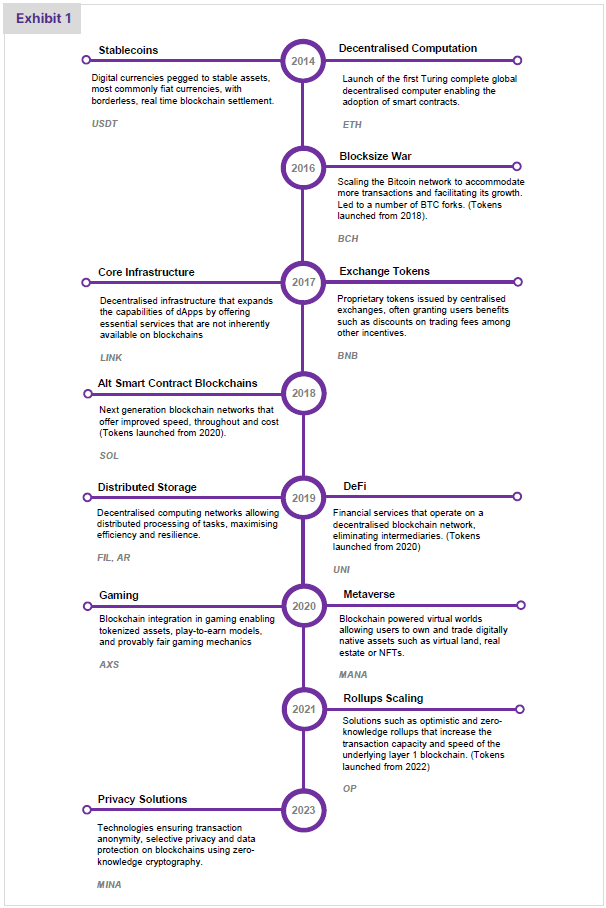

Complexity - Many emerging sectors (see Exhibit 1) rapidly expanding the investment landscape.

The liquidity injected by central banks globally with the onset of the coronavirus pandemic in 2020 sent crypto markets (as well as many others) into a phase of indiscriminate buying amplified by the high use of leverage, and culminating in Bitcoin’s peak at nearly USD 70,000 in November 2021. The tightening cycle that followed in 2022 triggered a rapid withdrawal of liquidity and reduction of leverage. Together with several high profile failures in the space (e.g. Terra/Luna, Celsius, FTX), this ultimately led to market capitulation by the end of 2022.

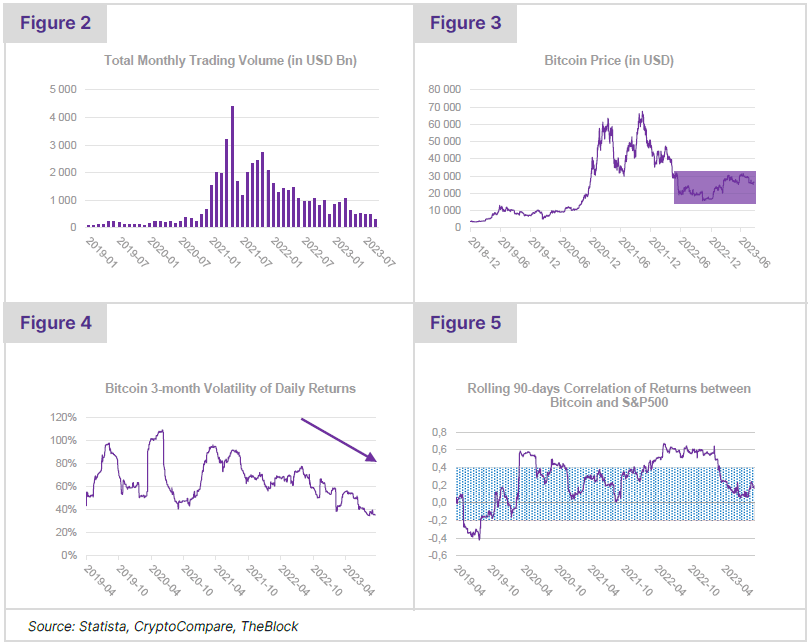

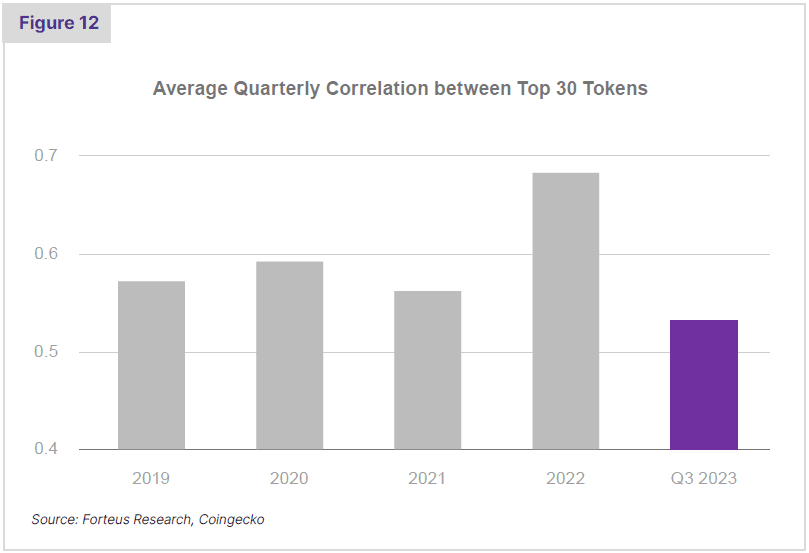

As institutional and retail investors stepped back from crypto markets, we saw trading volumes fall by more than 70% in 2023 vs. 2021 (Figure 2). However, through this challenging period for crypto, we have also started to observe promising signs of improved market health. These include stabilizing and rising asset prices (Figure 3), lower levels of volatility (Figure 4), and token prices increasingly driven by fundamental factors. The latter is best observed in a slowly decreasing level of correlation between tokens (Figure 12 on page 16).

An interesting by-product of reduced levels of leverage, and decreased participation from retail and institutional investors, has been a significant reduction in correlation between digital assets and other risk assets this year to levels approaching zero and closer to the historical mean (Figure 5). From this perspective, Bitcoin, and digital assets more generally, can provide a valuable source of risk diversification to portfolios once again.

The very light investor positioning in the asset class makes it interesting and contrasts with other assets. Together with slowly improving regulatory clarity (and growing support across many countries outside of the US), excitement surrounding the anticipated SEC approval of a spot Bitcoin ETF in the US, and a growing number of blockchain applications being tested and implemented by institutions and corporations, this makes for a more favorable investment outlook for digital assets in 2023 and beyond. For investors who are considering including or increasing crypto exposure in their portfolio, we take a closer look at how to do so.

A diverse set of Long-Only strategies

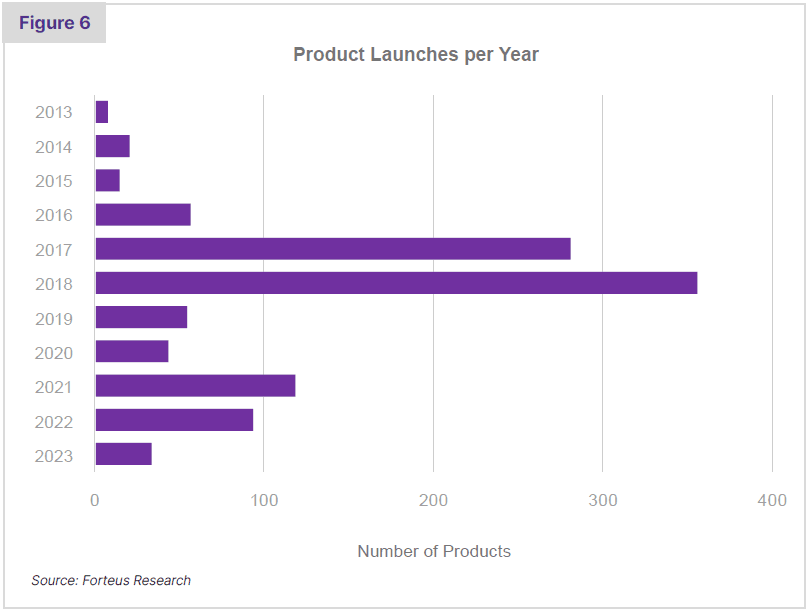

The first institutional digital asset product to gain significant traction with investors was the Grayscale Bitcoin Trust, which came into existence in 2013, offering clients easy access to Bitcoin and became publicly traded in the US in 2015. This was followed by a proliferation of long-only Bitcoin products, with the first ETP being launched in 2015. It was not uncommon to see these early products charging investors hedge fund type fees for passive long-only exposure.

This picture has drastically changed. Today investors seeking to build up a long exposure to the asset class are confronted with the challenge of identifying and selecting from a wide range of products. More than one thousand long-only crypto investment products have emerged over the last decade, totaling an estimated $200 billion in AUM. The majority of these were launched following the bull market of 2017, and there has been a constant flow of new products since (Figure 6).

Several types of investment strategies have emerged over the years that can be broadly classified as follows:

Passive strategies making up c.15% of existing product AUM:

-

Single Asset: Provide synthetic or physical exposure to a single token. Over half of these products and 95% of AUM are in Bitcoin or Ethereum, with the remaining 5% most commonly allocated to other top 10 tokens by market cap.

-

Multi Asset: Provide exposure to an index-like top N or sector-specific basket of tokens. These products typically apply systematic weighting (most commonly market-cap based) and low frequency rules-based rebalancing.

Active strategies offering nuances in return, risk, and liquidity profiles:

-

Active Long-Only:: Active selection, position sizing, and risk management of tokens, including positions in larger cap liquid tokens and running close to 100% long exposure at all times.

-

Liquid” Venture:: High conviction token selection typically in early-stage, less liquid names, possibly including private token sales. Typically have a lower portfolio turnover, they are the most common type of active funds in the space.

-

Fundamental Hedge Funds:: Actively managed portfolio of fundamental or event-driven positions running a high net long exposure, typically with higher portfolio turnover.

It is worth noting that the boundaries between these different categories can be blurry. For example, a Liquid Venture fund that invested into early stage tokens three years ago may now be holding a large amount of well-established tokens (such as Ethereum or Solana). The forward return profile of such a fund will very much resemble a more liquid Active Long-Only Fund.

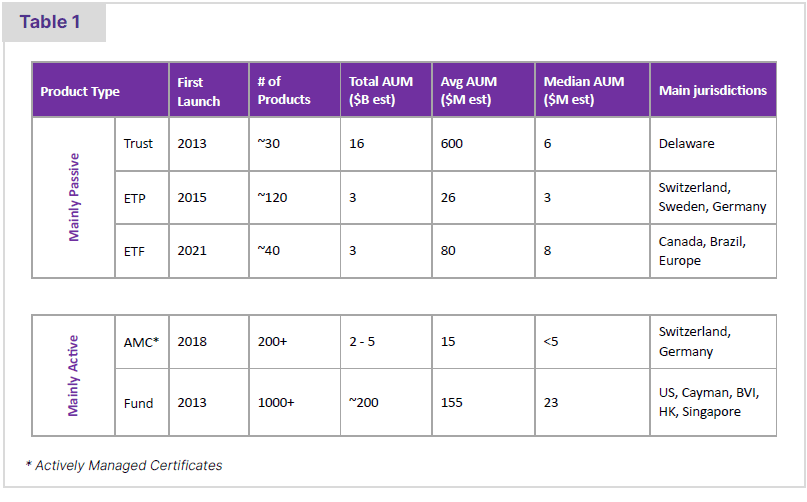

As new products have emerged, a variety of structures and vehicles have also proliferated creating a very fragmented market with a long tail of small products with AUM below $10M (Table 1).

Product nuances and cost implications

Beyond the merits of the investment strategies themselves (which we discuss further), there are many fundamental differences across these products that can lead to very different costs incurred by investors, including:

- Underlier: Some products hold futures rather than physical asset tokens which incur roll cost and can’t be staked.

- Liquidity: Listed products provide “instant” liquidity but at a cost (“bid-ask”) and with widely varying market depth.

- Staking: Not all products stake tokens and earn yield related to Proof-of-Stake blockchains, or in some cases charge a high fee for this activity.

- Other Income: Tokens can be lent out to generate additional yield (which should be done very carefully), but fees may be levied by managers.

- Fees: Management and performance fees differ significantly across products - mgmt fees can still reach 2.5% for passive products and incentive fees 25%+ for active products.

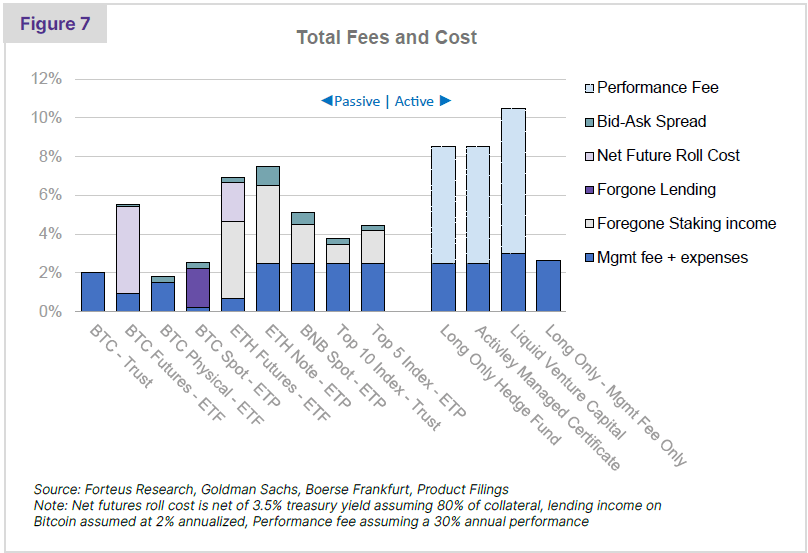

We cover all of these dimensions in more detail below. These can have a substantial impact on long-term performance as illustrated in Figure 7 which adds up the cost of holding various investment vehicles, amongst the largest in the industry, for a 1-year period assuming a 30% fund performance. This includes opportunity costs such as leaving stakeable assets unstaked, or fees charged on the yields generated by these activities. Besides simple Bitcoin only products, many passive products have a total cost of over 4% per annum once foregone income is accounted for!

Generally, we would expect products to offer:

- Management fees aligned with the cost of running the strategy and hence to be higher for active products (typically 2%) vs. passive products (typically sub 1%).

- No future-rolling cost as spot products are preferred.

- Staking yield to be collected and entirely passed on to investors.

- No performance fees on passive products.

- A cap on fund costs (critical for smaller sized products).

Physical tokens rather than derivatives-based

Long-only products can either hold derivatives or physical tokens. This distinction is important. The earliest ETPs held derivatives rather than physical tokens, as is common in commodity ETFs and ETPs. For regulatory reasons, to date, US-based ETFs can still only hold CME futures rather than physical tokens themselves. As in other asset classes, futures-based products introduce a number of issues, particularly higher costs associated with:

- Future roll cost (or funding cost) which are typically only partially compensated by interest received on collateral.

- Lost staking income as futures do not capture the staking yield otherwise available to holders of physical tokens (relevant for certain assets only including Ethereum but not Bitcoin).

To illustrate this, in the first 8 months of 2023, the additional cost for an ETH future-based ETF compared with owning and staking physical ETH sums up to about 5.5% on an annual basis. This cost includes 4% in forgone ETH staking rewards, a 5% roll cost for ETH futures (using a 6-month median roll for CBO futures), offset by a 3.5% annualized interest income from potential collateral held in Treasuries.

While there is no staking yield on Bitcoin, the annualized roll cost alone is close to 8%.

The cost of liquidity

Another major distinction between products lies in their liquidity terms. Exchange-traded products provide daily liquidity. In contrast, funds typically operate on monthly or quarterly redemption cycles, with a few exceptions that offer weekly liquidity.

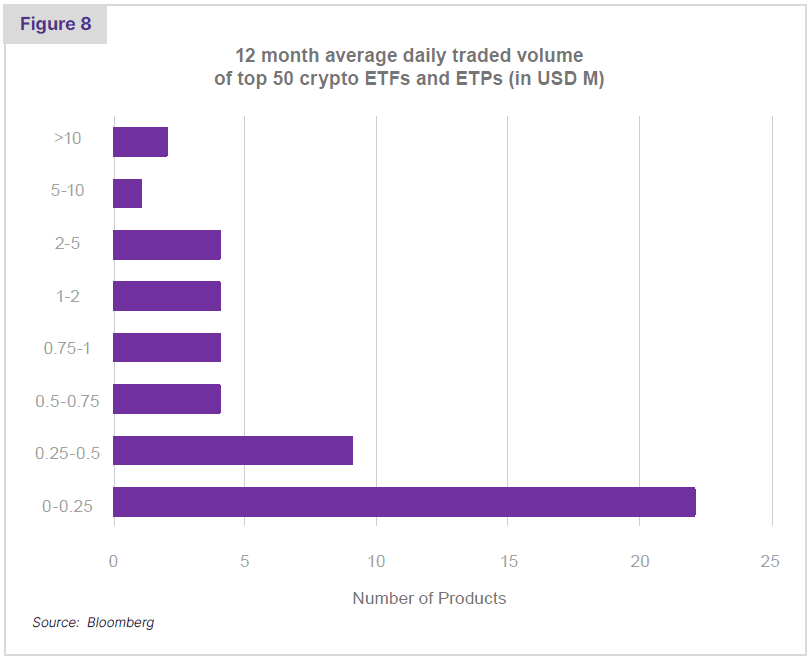

While instant listed liquidity has its benefits, it may also impact the ability of the fund to stake its assets. It is also worth noting that trading volumes on the vast majority of ETPs remain very thin and therefore suitable only for smaller investment sizes. Amongst the top 50 listed instruments by AUM across the main exchanges in the US, Canada, Scandinavia, and Switzerland, nearly 80% of these trade less than USD 1M per day (see Figure 8). This can often lead to wide bid-ask spreads.

The importance of staking and other sources of yield

Digital Assets can be an important source of income for crypto investors, but not all products optimize for yield, and many do not pass these returns onto investors. It is, therefore, crucial for investors to understand what yield can be generated from the crypto that they own and whether they are benefiting from this additional source of income from the products they invest in.

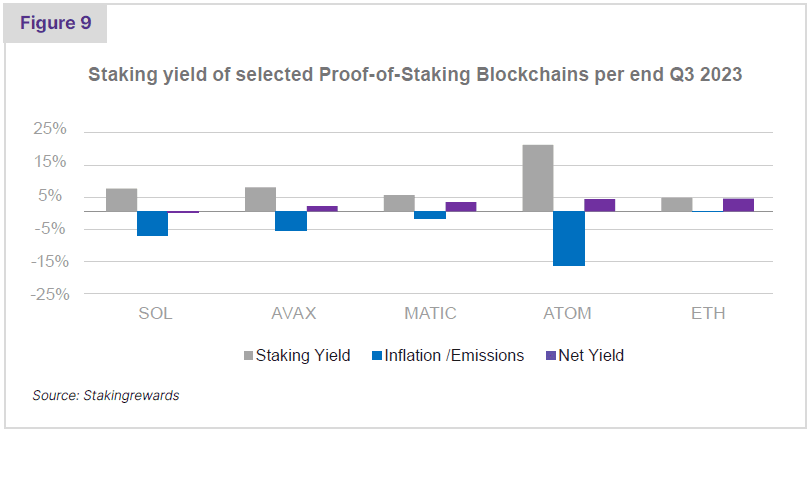

Staking (PoS) Today, Proof of Stake blockchains account for approximately one third of the crypto market capitalization, with Ethereum being the most prominent. These blockchains allow participants to “stake” their tokens, effectively locking them up, in order to participate in transaction validation and block creation on the network. In return for staking and securing the network, participants receive rewards in the form of a yield on the assets staked.

The rewards generated through staking are significant, with the average yield on the top 10 PoS blockchains at 5.0% in Q3 2023 (weighted by token market cap) and can often more than cover a fund’s fees and costs. As illustrated in Figure 9, certain tokens also have high inflation or token emission rates which can be offset by staking rewards. In such cases, holding a token without staking it can significantly degrade performance. When staked, ATOM has an expected annualized yield of 3.5%. However, if the tokens are not staked, the yield is a negative -16.6%.

Staking should, of course, be undertaken subject to the liquidity terms of any fund. With the right practices in place, there is little to no counterparty risk - some Proof of Stake assets can be delegated directly from cold custody, while others require depositing into a smart contract. Operational risks related to the activity, such as slashing, which can occur if a validator acts erroneously, can be insured against and further reduced by diversifying the set of staking providers used.

Other sources of yield

Certain DeFi yield capture activities involve staking but this is fundamentally different to the staking that secures Proof of Stake blockchains described above as well as being significantly higher risk. With the proper risk management in place, this activity may generate attractive yields for investors, however, these activities should generally not be undertaken in liquid long-only products and managers should be transparent about this.

Token lending markets have also emerged offering investors additional yield on their portfolio, similar to traditional securities lending and repo markets. In crypto, these short-term lending markets are still immature and have experienced a number of issues in the past driven by insolvencies of the likes of 3AC, Alameda, Voyager, Celsius, BlockFi, etc.

It is critical to understand the counterparty risks involved and who the tokens are ultimately being lent to. Investors should have transparency on whether their manager is lending out tokens and under what setup. If so, the proceeds from this activity should flow to the investor.

Token diversification: the opportunities beyond Bitcoin

With roughly 70% of market cap held in just two tokens, the concentrated nature of the crypto market is quite unique. Although there is no way to simply “buy the market” as one can do in equities (e.g. MSCI World), one could argue that owning 70% of the market is a good enough proxy. However, this approach risks missing out on significant opportunities.

As with early-stage tech investing, the pace of innovation is fast and new sectors emerge rapidly. More specifically, in the case of digital assets, since the ICO boom in 2017, many waves of innovation have created entirely new sectors in the digital asset universe that did not previously exist. Exhibit 1 charts some of the main themes, and associated tokens, that emerged between 2014 and today.

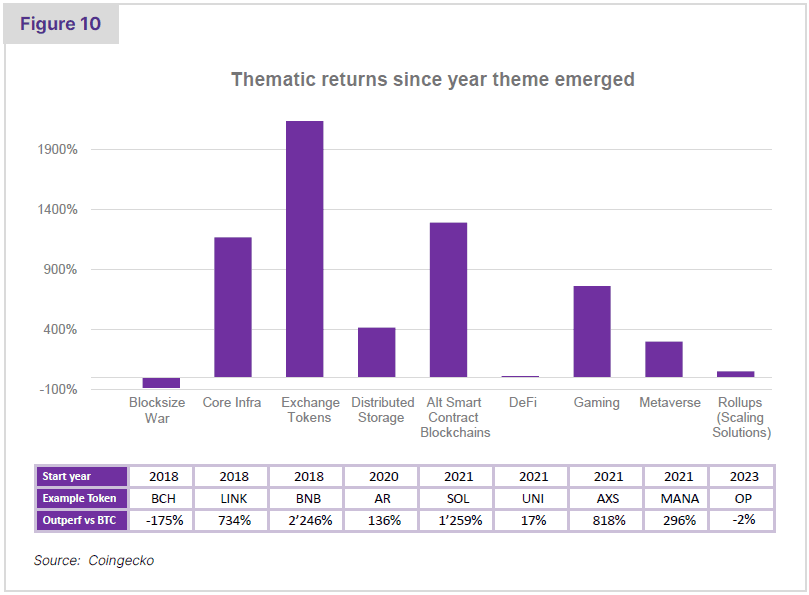

These waves of innovation have resulted in some of today’s most valuable tokens. Identifying and investing in these trends holds the promise of considerable returns. In Figure 10, further below, we showcase the performance of select tokens for the theme identified in the timeline above. Returns are calculated and benchmarked against Bitcoin from the full year following the emergence of the theme or the token (in some cases the tokens emerged only later).

These new digital asset sectors now represent around ⅓ of the market and are diversified across a wide range of applications, as illustrated in Appendix 1. The universe today offers a vast range of investment opportunities beyond just Bitcoin and Ethereum, encompassing core blockchain infrastructure and applications.

The benefits of active management

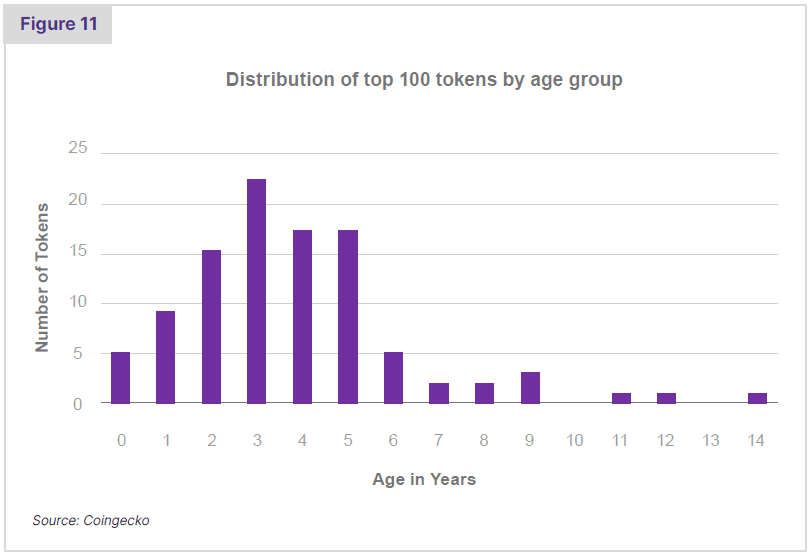

The constant emergence of new trends and their associated tokens has led to a significant rotation of assets on the “leaderboard”. Since the beginning of the last cycle starting June 2020, 5 of the top 10 tokens and 11 of the top 20 tokens are no longer in those respective groups. This type of rotation in leadership has made it harder to run a stable passive index product. In fact, the median age of the current top 100 tokens by market capitalization is only 3.9 years as shown in Figure 11.

Recently, we have started to observe greater price dispersion across tokens, with prices increasingly driven by fundamentals, such as application upgrades, governance decisions, or improved operating metrics. Although we are still in the early stages of this trend, it’s evident through the steady decrease in correlation between tokens, as shown in Figure 12. With an average correlation of 0.5 amongst the top 30 tokens, we are still far from the lower levels observed in equity markets. As market participants deepen their understanding of digital asset tokens, we expect to see a continuation of this trend with increasing dispersion amongst winners and losers.

The fast pace of innovation and ongoing emergence of new trends combined with more differentiated price movements across tokens will generate opportunities for active management. This requires many of the same due diligence skills and deep understanding of the industry that one would expect from any early-stage tech investor. There are, however, some unique considerations in the digital asset space that are worth highlighting:

- Fundamentals: Understanding how token holders participate in the value creation generated by the underlying technology or application (not all tokens are created equal).

- Liquidity: Managing the liquidity profile of the tradable token (not a private VC asset).

- Information access: Making use of the unprecedented level of transparency that blockchain technology provides from open source code to strategic decisions made on open governance forums and operational metrics visible to all on-chain.

The minimum requirements for safe ownership

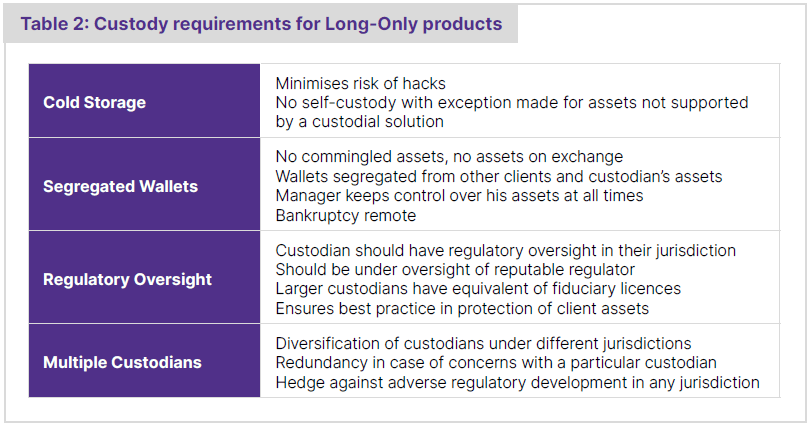

Safe custody is a critical consideration for any asset manager operating in the crypto markets and specialist technology is required to securely store a fund’s assets. There are a number of crypto-native custodians such as Coinbase, Anchorage and Copper that offer various custody solutions, while a number of large traditional financial institutions such as Fidelity, BNY Mellon, Nomura and Standard Chartered have also entered the crypto custody space. When it comes to custody for long-only products with minimal turnover, we expect to see the following requirements and characteristics:

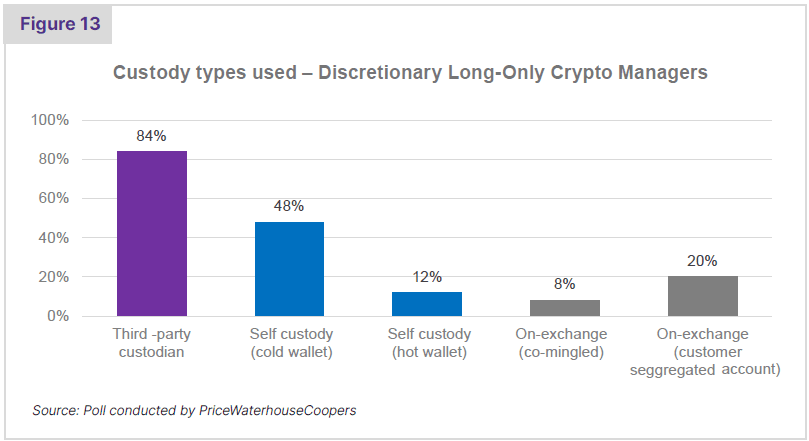

These practices are yet to be fully implemented across the industry as highlighted by a PWC poll of discretionary long only crypto hedge funds who were asked what type of custody solutions they use and which is illustrated in Figure 13 below.

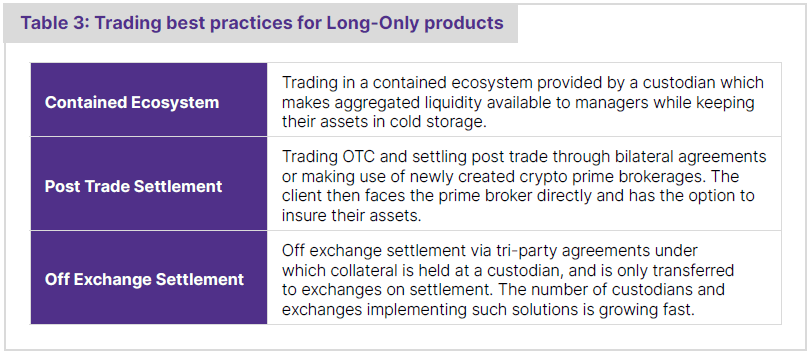

When trading digital assets, asset managers can trade directly on exchanges such as Binance, Coinbase, Bitstamp, etc. Typically, this requires pre-funding on co-mingled wallets, which exposes investment funds to the counterparty risk of exchanges. The various market events from 2022 highlighted the importance of managing exchange counterparty risk and have led to the acceleration of mitigation techniques to manage this risk. We would expect any long-only product to take advantage of these developments. Several setups are possible nowadays including:

Conclusion

Digital asset markets in 2023 provide a much healthier backdrop for investors seeking a directional long exposure, with light investor positioning and significantly reduced speculative leverage. The early signs of a maturing market increasingly driven by fundamentals are encouraging and present numerous investment opportunities.

For investors looking to take advantage of this early-stage but slowly maturing investment opportunity, there are a wide range of strategies and vehicles available. The proliferation of such product choices in recent years is a strong positive for investors but requires careful diligence as many disparities exist. Evaluating the current landscape of passive and active products, we highlight the following conclusions:

- Spot based products should be preferred to futures-based ones as they present more direct ownership, avoid future-roll cost, and allow for staking.

- Few listed products offer deep liquidity and are often associated with a non-negligible trading cost in the form of bid-ask spreads.

- Token staking for PoS blockchains is an attractive additional source of income that should be captured and fully passed on to investors.

- Token lending should be reviewed carefully as it may introduce additional counterparty risk; any benefits should be fully passed on to investors.

- All-in costs on passive products often range between 4 and 7.5% when foregone income is accounted for.

- Diversification beyond Bitcoin can be attractive over time as it gives access to a wide range of blockchain innovation but requires careful selection.

- Actively managed products have merits in a high-volatility environment where token performance is increasingly driven by fundamentals.

- Crypto assets should be held in segregated cold-storage wallets, managed by one or, preferably, multiple regulated custodians. Exceptions can be made in rare instances, such as for trading or handling niche or esoteric tokens.

As we publish this report, investors appear to be slowly turning their attention back to digital assets for the first time in nearly a year and recognizing its potential as a source of portfolio diversification and return-enhancement. Trading volumes have increased, most recently driven by the expected SEC approval of spot ETFs in the US, as well as the compelling benefits of Bitcoin and digital assets more broadly given the increasingly challenging current macro environment. With ongoing advancements in blockchain technology across various applications in an industry that is learning from the setbacks of 2022, it is an interesting time to be reassessing a space that has largely been overlooked in the past year.

The Forteus Team

About Forteus

Forteus is the asset management arm of the Numeus Group, a global digital asset investment firm with 40+ people and offices in Zug (Switzerland), New York, London and Mauritius. For more information please visit www.forteus.com or contact us at info@forteus.com

Appendix