Introduction

From humble beginnings among a small group of successful traders just a few years ago, the crypto hedge fund space has quickly grown to become an established industry.

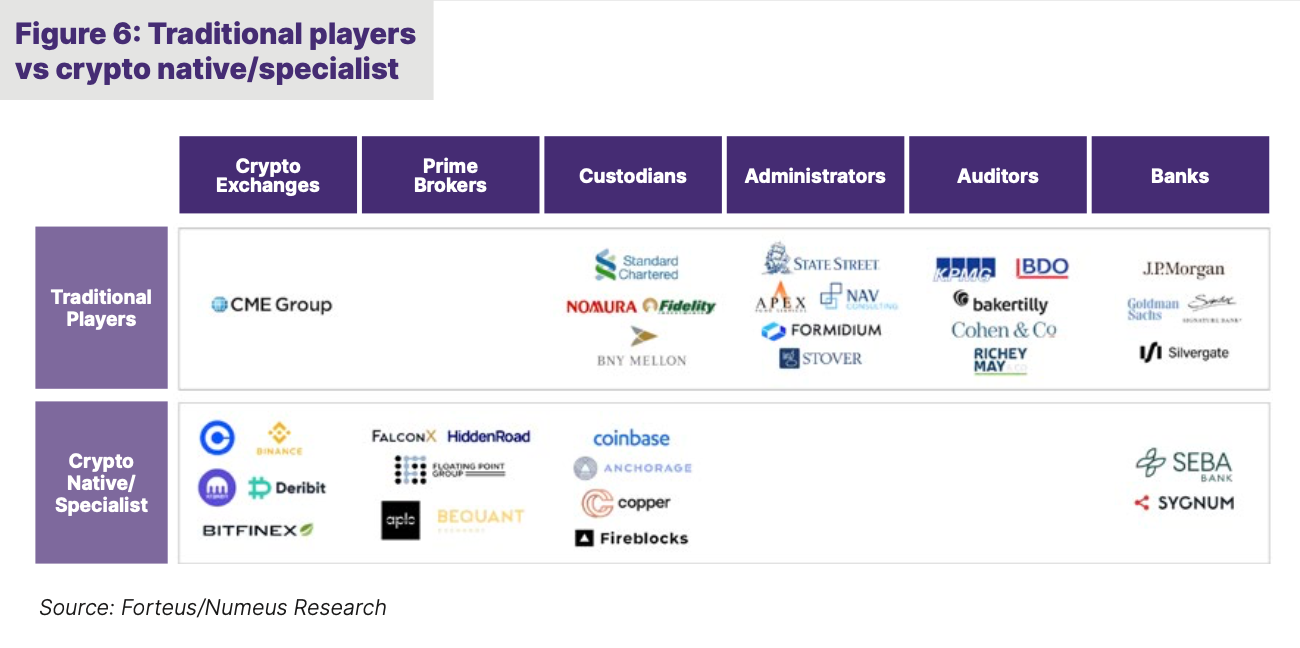

This development has been characterised by the emergence of hundreds of new funds, a migration of talent from traditional finance into digital assets, and the launch of dedicated crypto strategies by established hedge funds. Furthermore, there has been a proliferation of new services being offered to crypto hedge funds by both crypto native firms and traditional service providers.

Similar to traditional hedge funds in the late 1990s and early 2000s, crypto hedge funds today are able to take advantage of an abundance of alpha opportunities that are available in crypto markets.

Despite its rapid growth and opportunity set, the crypto hedge fund industry remains poorly understood, even among dedicated hedge fund investors, and allocators need to be aware of the unique challenges when selecting crypto funds.

This report details the evolution of these new managers and sets out where the industry stands today. We compare crypto hedge funds with their traditional counterparts, provide a classification framework for the crypto hedge fund universe and describe the main strategies deployed by managers.

The events of 2022 were challenging for crypto fund managers and have highlighted the importance of manager selection, operational due diligence and counterparty risk management. We take a closer look at how crypto funds have reacted to challenges, most notably the “crypto winter” of 2018 and some high-profile collapses in 2022, and comment on the outlook going forward.

Emergence of a New Industry

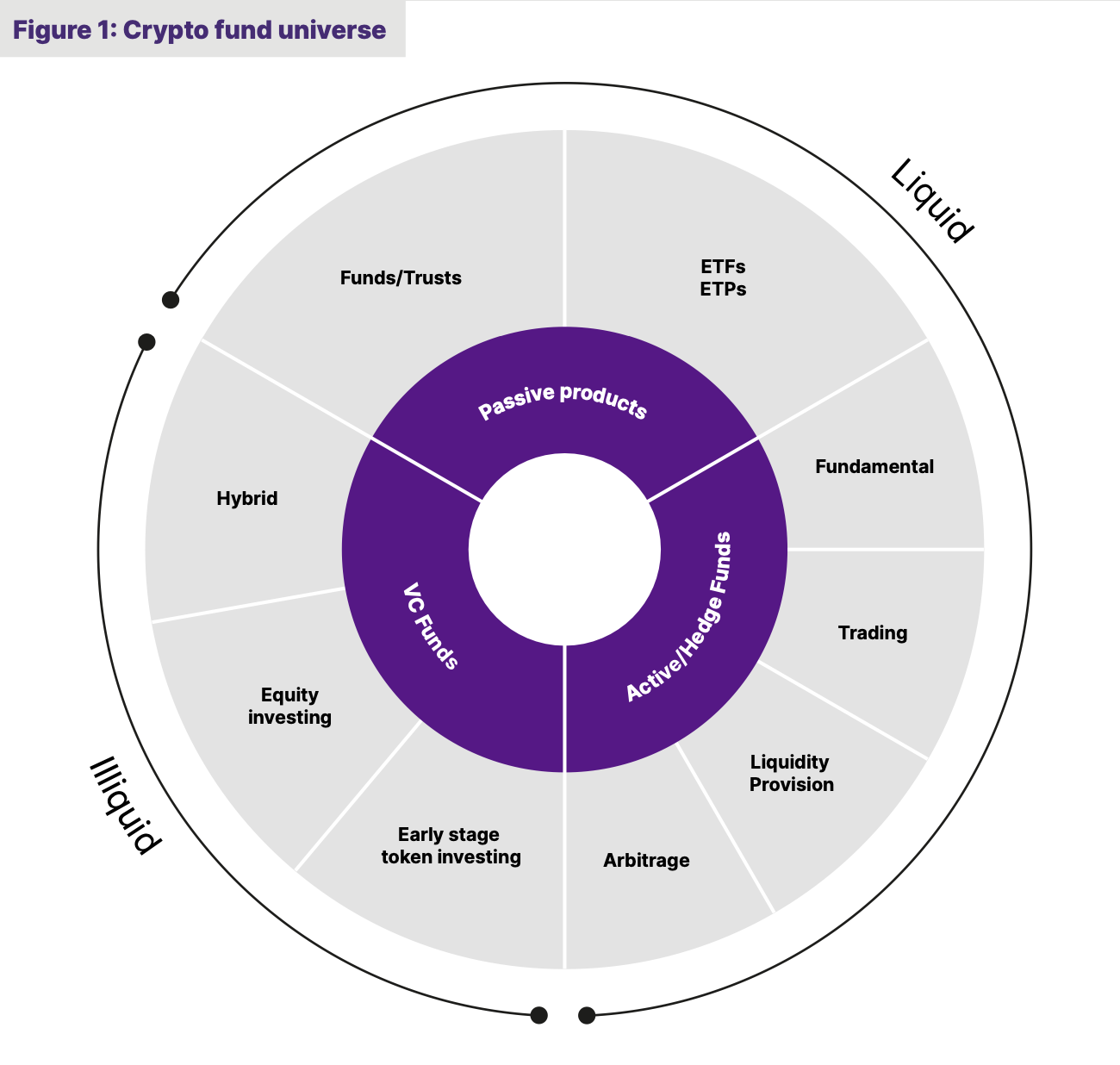

Funds that provide investors with exposure to digital assets can be divided into three categories: hedge funds, venture capital funds and passive funds as shown in Figure 1 below. These categories are broadly defined by their liquidity profile and by whether they follow an active or passive approach.

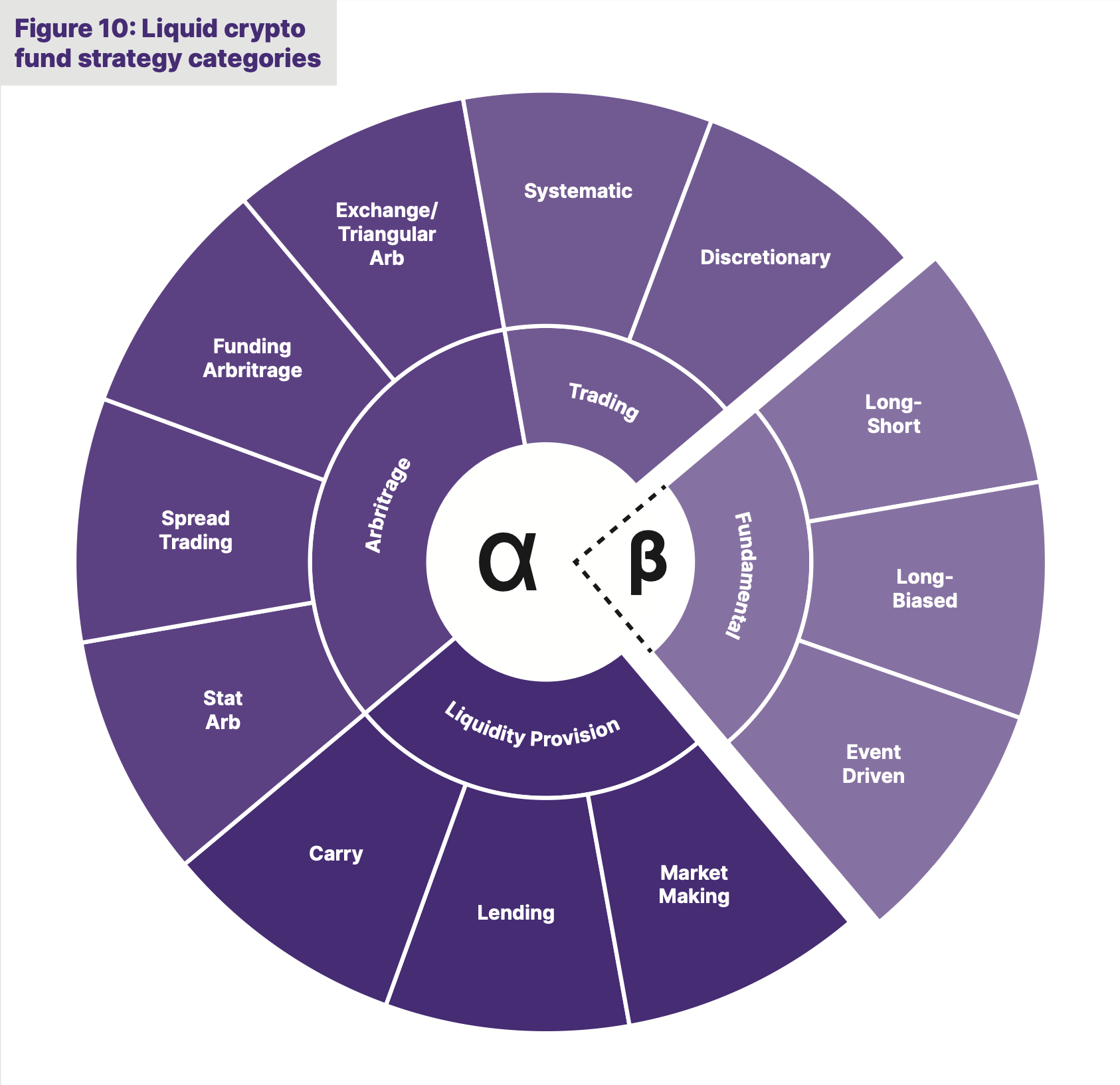

This report will focus on liquid crypto hedge funds, which we further classify into four primary sub-strategies: Arbitrage, Liquidity Provision, Trading and Fundamental.

The development of the crypto hedge fund industry shares a number of similarities with traditional hedge funds in the late 1990s/ early 2000s.

The traditional hedge fund space was initially dominated by a group of renowned global macro funds run by prominent traders, before developing into a much more diverse ecosystem covering a range of different strategies.

Similarly, the crypto hedge fund landscape has been evolving at a fast pace since 2018, as the universe of funds has evolved to incorporate a wide array of uncorrelated alpha-centric strategies deployed by teams across the globe.

Crypto hedge funds are also following a similar pattern of investor adoption, with high net worth individuals (HNWI) and family offices being the early adopters, while more recently, dedicated crypto fund of funds have been emerging. In the mid 1990s, the traditional hedge fund space was still a cottage industry which did not evolve into an established investment category until the early 2000s when institutional investors became more active, talent migrated from banks and new service providers emerged. Over the coming years the crypto hedge fund industry looks set to follow a similar trajectory, although the events of 2022 have certainly delayed institutional adoption and it is likely that many institutions will look for signs of stability and greater regulatory oversight before they commit to the sector.

Ongoing Growth

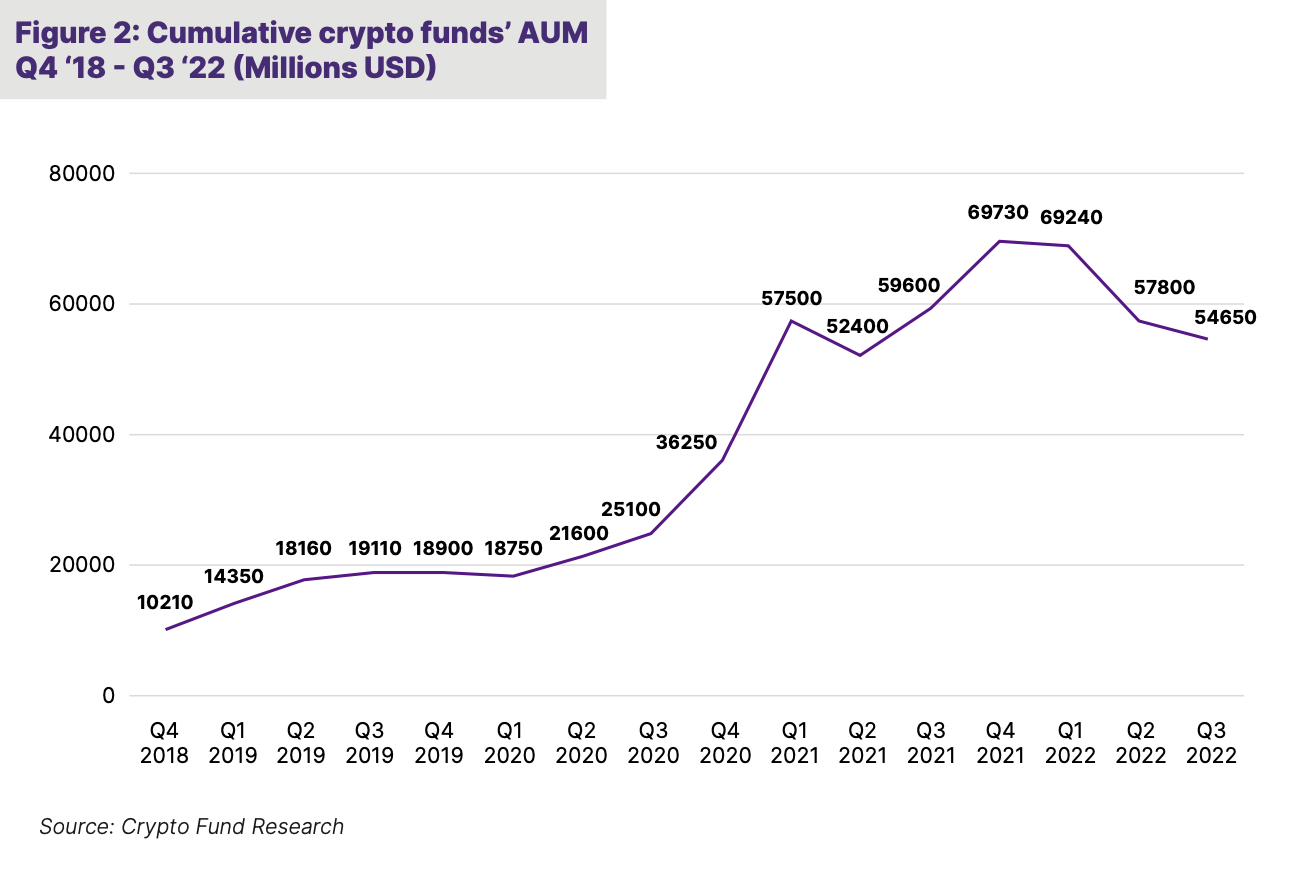

Investor interest in crypto funds has grown substantially in recent years, with assets under management (AUM) across all funds rising from USD 10bn at the end of 2018 to a peak of USD 70bn in late-2021, before falling to 55bn by Q3 2022 (see Figure 2 below). There are now more than 800 active funds, with the liquid crypto hedge fund category making up nearly half of this total.

The growth of crypto hedge fund AUM has also led to many of the leading funds to limit investor access. Therefore building strong relationships and securing capacity rights with managers has become a true differentiating factor for allocators.

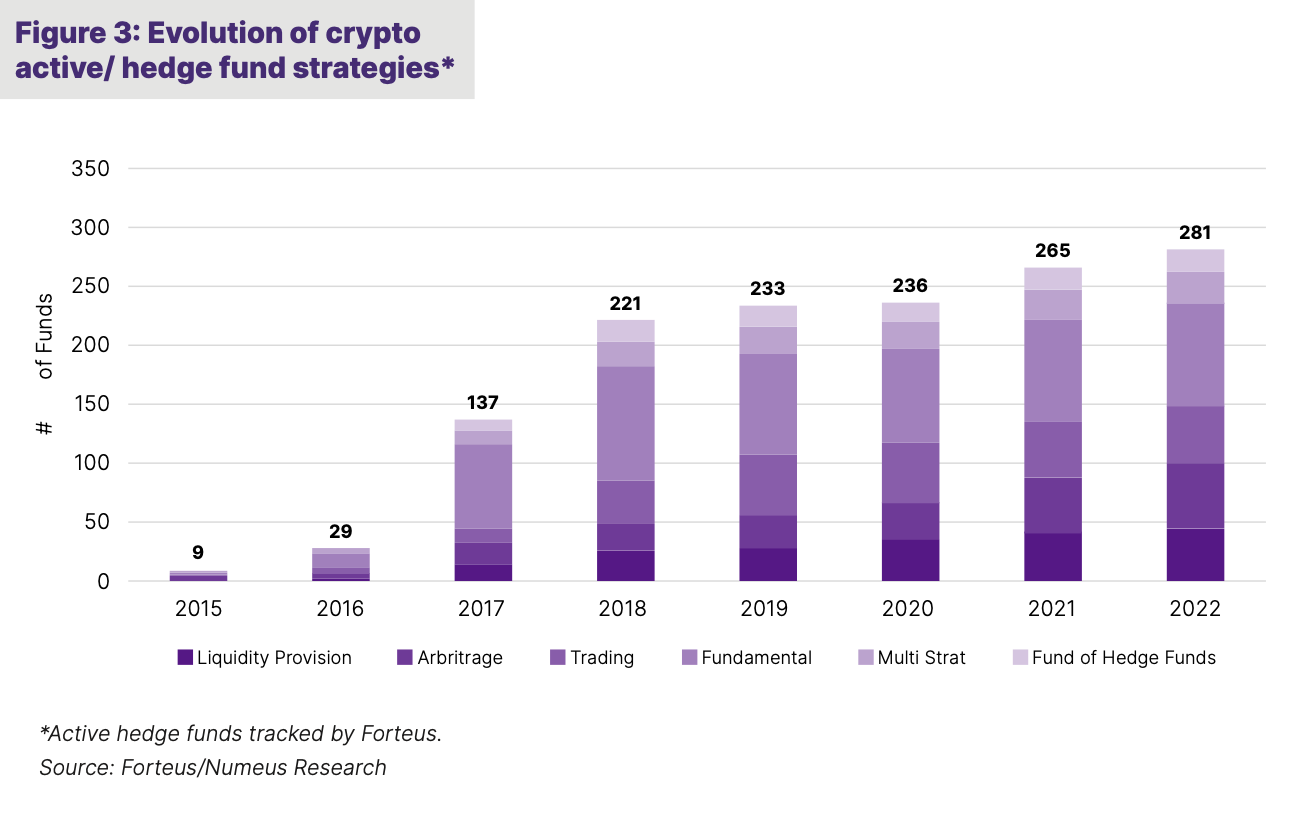

As the industry has grown, crypto markets have also increased in complexity. With new trading venues (both unregulated and regulated) and the emergence of derivatives, a wider range of investment strategies have been developed and implemented. As illustrated in Figure 3 below, the proportion of “alpha-centric” strategies (Arbitrage, Liquidity Provision and Trading) has increased significantly since 2017.

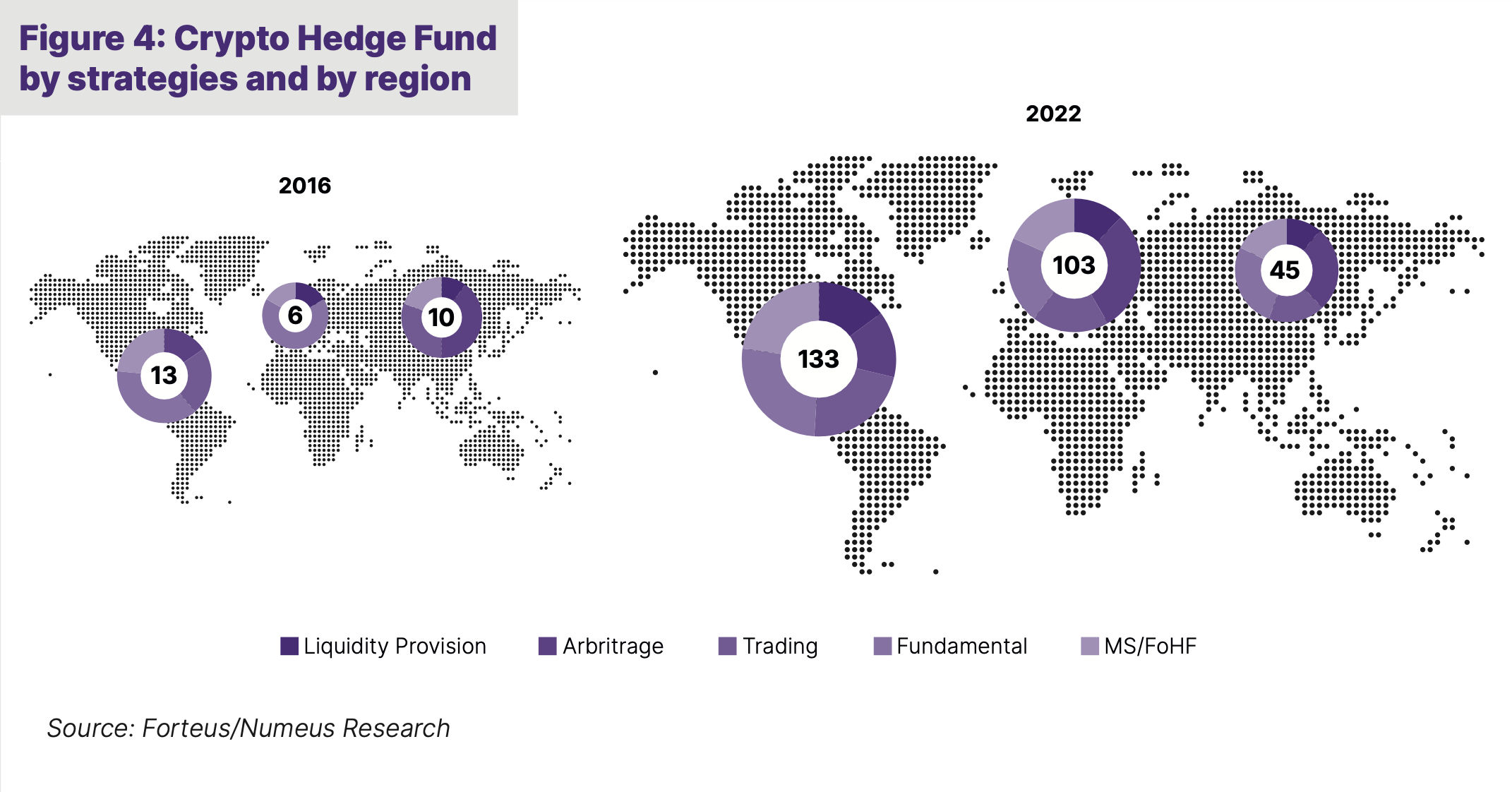

Geographically, crypto managers have predominantly established themselves in hedge fund hubs such as New York, London or Hong Kong, allowing them to leverage existing hedge fund infrastructure, investor base and pools of talent. European and Asia- based managers tend to favour an active approach while their US counterparts lean more towards passive strategies (Figure 4).

Talent Shift to Crypto

One of the key trends has been the migration of talent from traditional finance towards digital assets. Both buy-side and sell-side professionals have identified the rich alpha opportunities within crypto markets and have been joining the industry in increasing numbers. This talent shift has brought to the industry much needed experience in managing risk and running best-in-class operational processes.

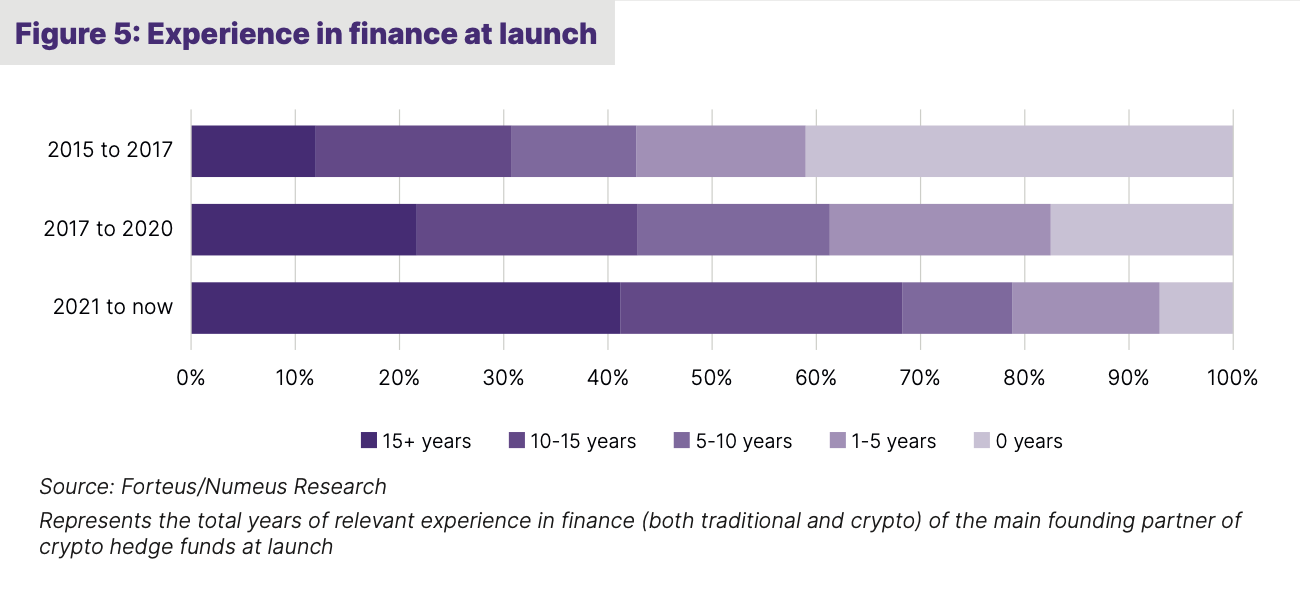

As shown in the figure 5 below, the majority of new crypto funds are now being launched by experienced hedge fund professionals with careers of 10 or more years in finance. This is a significant shift from the same picture only a few years ago.

Institutional Grade Infrastructure

A major obstacle to the widespread institutional adoption of crypto has been the lack of institutional grade infrastructure. However recent developments, including the growth of service providers and the emergence of more specialist firms, have supported greater adoption.

Singling out crypto custody, this has become an increasingly competitive area. Crypto fintechs such as Copper and Anchorage are now up against traditional firms that include the likes of BNY Mellon and Fidelity. But traditional and crypto firms have also been working together, a good example being Coinbase which has recently partnered with Blackrock to make crypto trading available through the latter’s widely used Aladdin platform.

However, despite this encouraging progress, it still remains early days. Crypto prime brokerage lacks the presence of large balance sheet firms and crypto exchanges remain fragmented amid an uneven landscape. Furthermore, the collapse of FTX has undoubtedly undermined trust in crypto service providers, although the resulting increase in regulatory oversight and improvements in corporate governance and controls should ultimately be beneficial for the industry and its participants.

Today’s Crypto Hedge Fund Landscape

An Alternative to Traditional Alpha Erosion

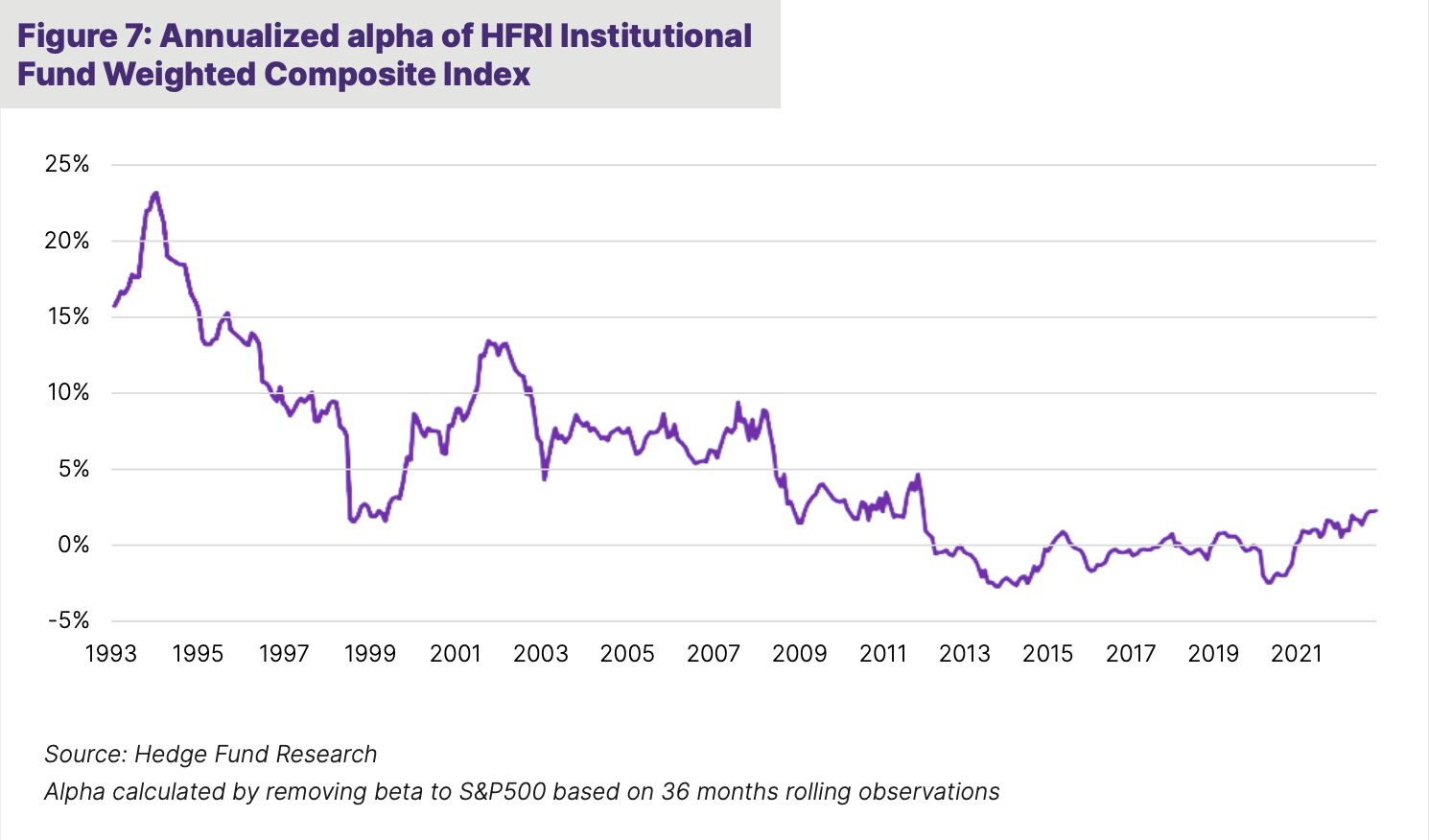

Crypto hedge fund investors have been primarily attracted by the diverse sources of alpha and robust absolute return opportunities. By contrast, traditional hedge funds have witnessed a progressive erosion of returns and alpha capture over the past two decades, generating close to 0% of alpha when compared to the S&P 500 for most of the past 10 years (as illustrated by the 36 month rolling alpha of the HFRI in figure 7 below).

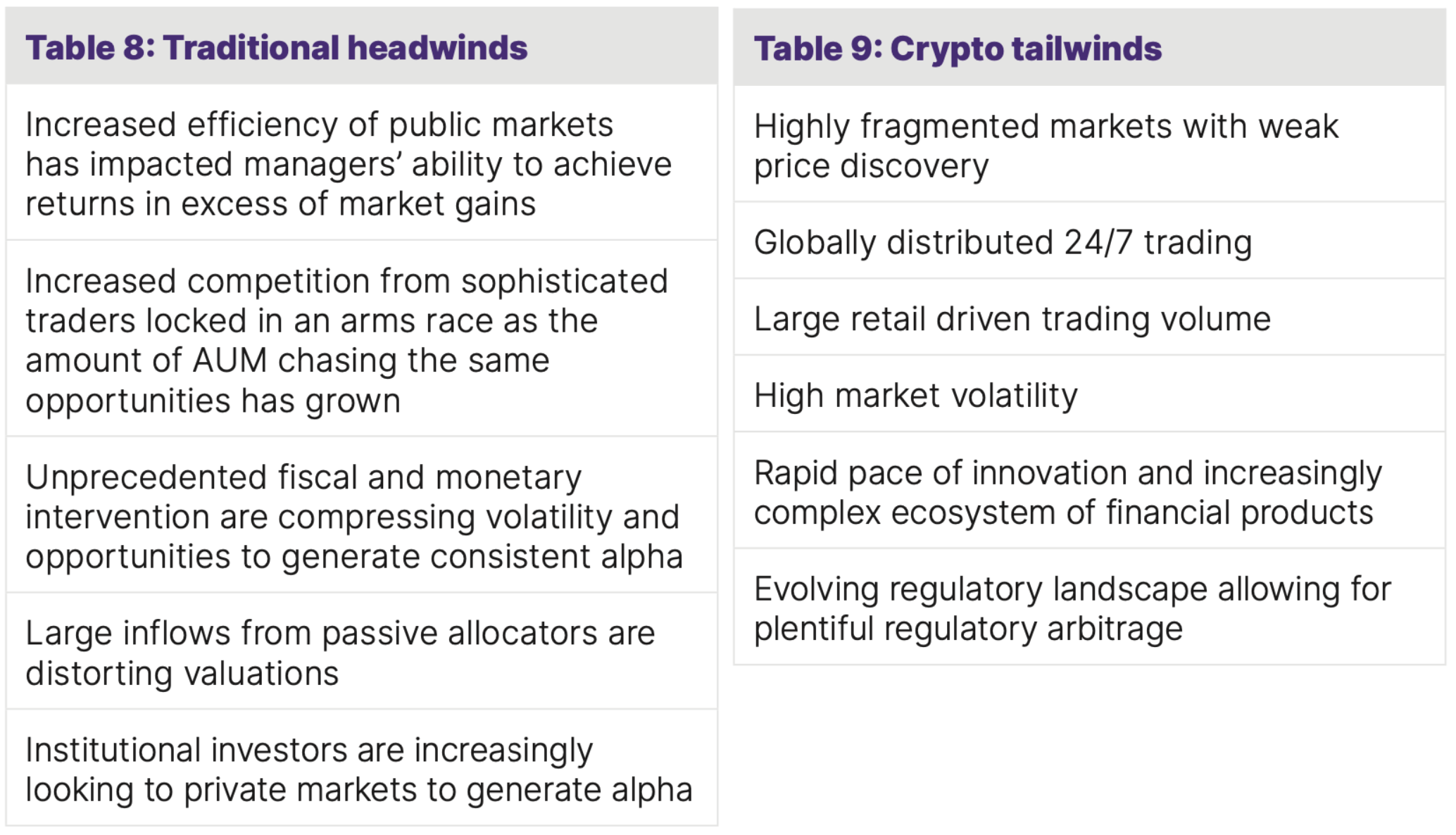

Alpha extraction from traditional markets has faced significant headwinds which can be explained by several factors, as explained in table 8.

Conversely, crypto hedge funds are in a unique position to benefit from market conditions that are ripe for alpha extraction. This mirrors the profitable opportunities in the early days of traditional hedge funds in the 1990s and early 2000s. As an asset class, digital assets present significant structural inefficiencies that traders and investors can benefit from, as set out in table 9 below.

A Diversified Universe of Strategies and Rich Source of Alpha

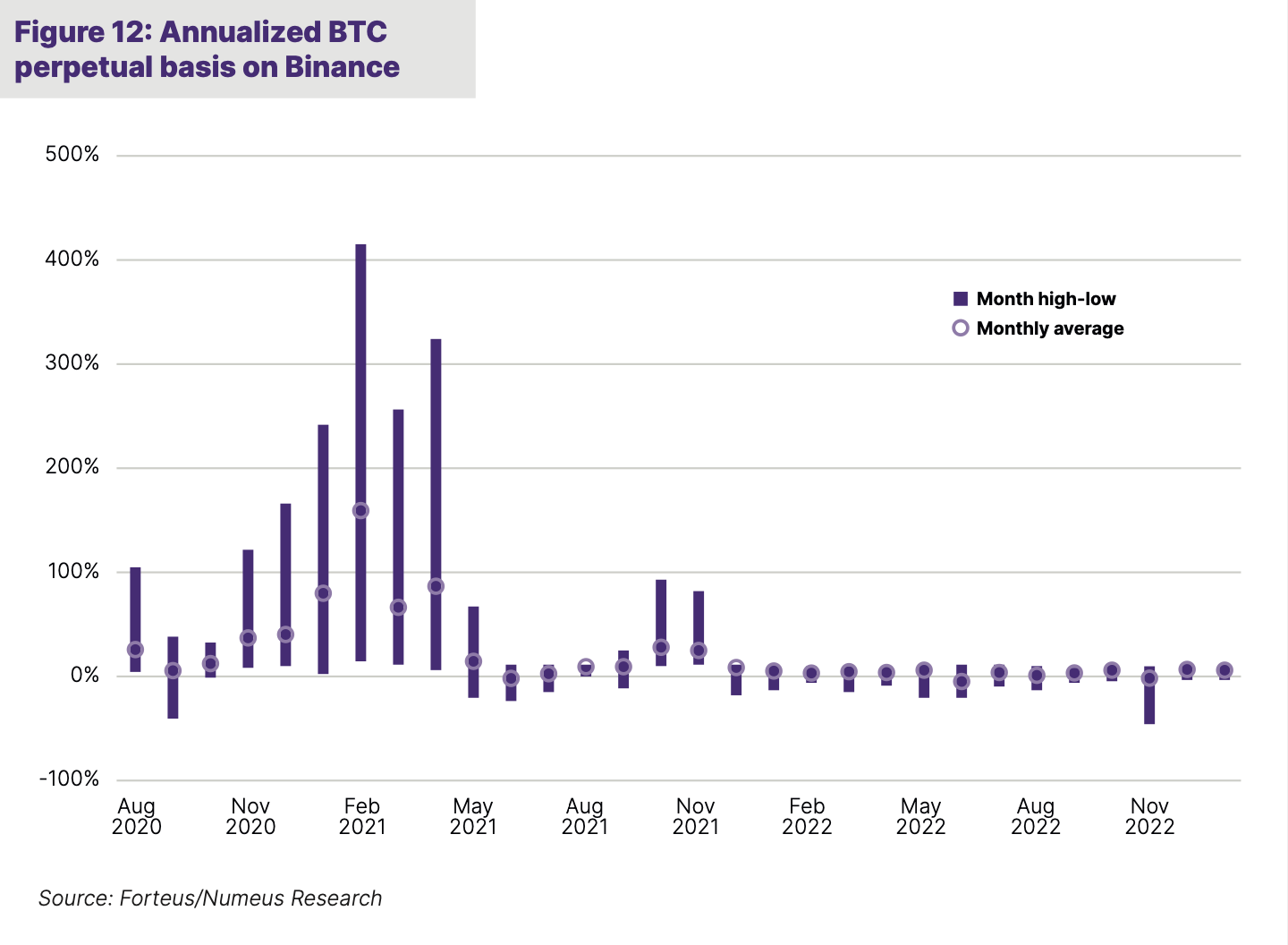

The liquid crypto hedge fund universe now consists of a wide range of strategies which we classify into four primary categories: Arbitrage, Liquidity Provision, Trading and Fundamental. These strategies are further broken down into twelve sub-strategies (see figure 10).

There are many parallels here with strategies deployed in the traditional hedge fund space. Fundamental managers are similar to traditional stock pickers, selecting undervalued assets and in some cases shorting those that appear overvalued. In the crypto space, these managers typically run with a structural long exposure and therefore provide investors with a systematic “long beta” to crypto markets, while also seeking to generate alpha through token selection.

Arbitrage, Liquidity Provision and Trading managers are generally “alpha-centric”, in that their returns are not driven by a structural long exposure to the crypto-market. Instead, they generate alpha by identifying unique sources of returns, taking advantage of market price dislocations or through various forecast-based trading strategies. We list some examples in exhibit 1.

We discuss below two of the particularities of crypto markets that offer material sources of alpha to managers: the highly fragmented trading venues and the breadth of financial products such as derivative instruments.

Benefiting from a Diverse Set of Venues

Crypto hedge funds can benefit from geographical differences between exchanges, a notable example being the “Kimchi premium” trade. Throughout 2017 and 2018, prices for cryptocurrencies on South Korean exchanges were more than 50% higher than on other platforms, largely because of the country’s capital control laws.

Trading opportunities in the crypto space are constantly evolving and the fragmented nature of how digital assets trade leads to a number of price dislocations. There are over 400 trading venues, with very different characteristics, including:

• Centralised crypto exchanges, or CEX (such as Binance, Kraken, Coinbase or OKX)

• Decentralised exchanges, or DEX (such as Uniswap) that emerged with the growth of the DeFi industry in 2021

• Various listed access products on traditional regulated exchanges, most notably the Grayscale Investment Trust holding BTC and CME Futures

Bitcoin is also traded against a wide range of fiat and digital pairs, creating further opportunities to arbitrage across a range of venues with very different liquidity profiles.

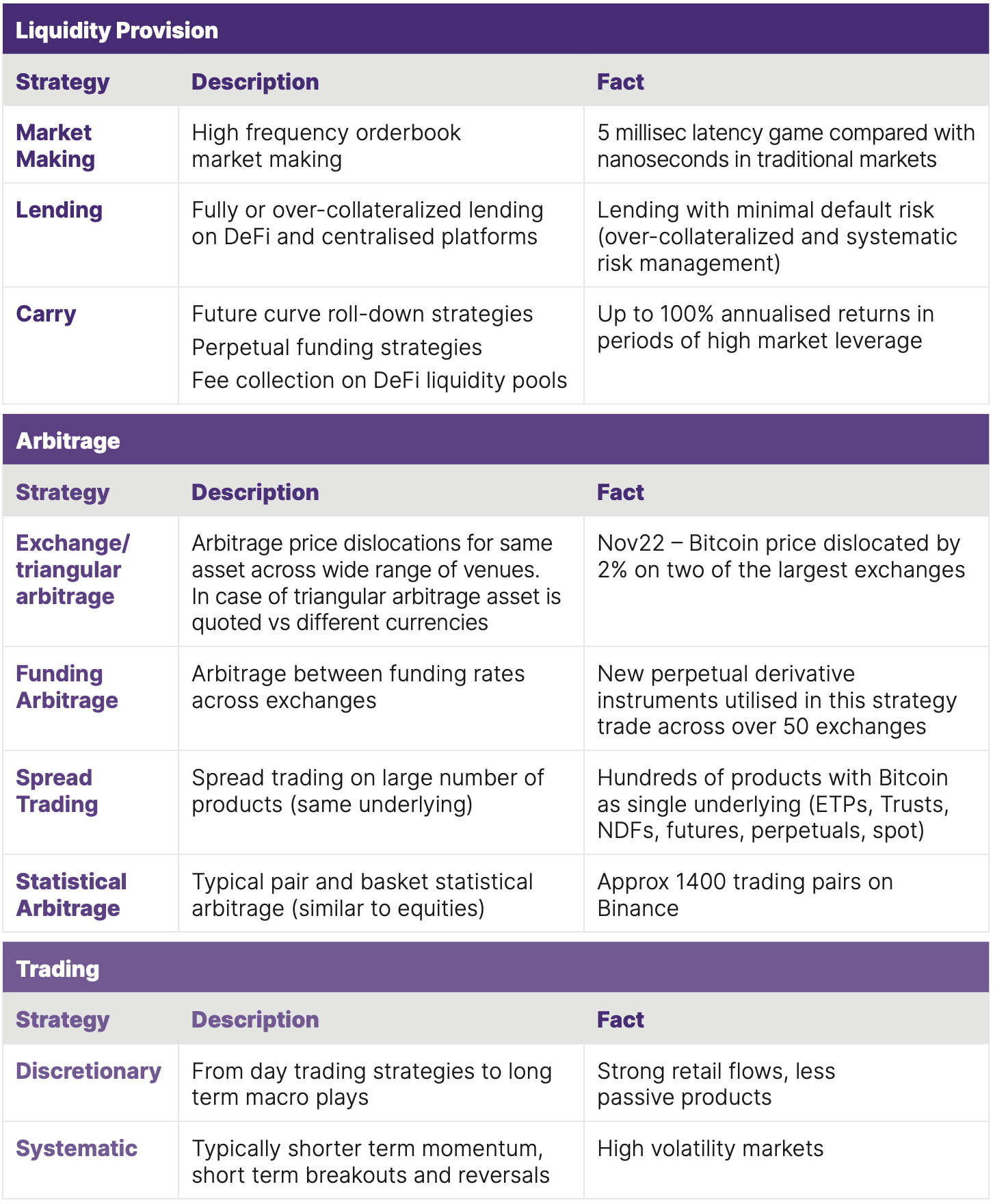

As an example, during the market turbulence caused by the collapse of FTX, the tick-by- tick data of ETHUSDT on Binance and OKX diverged by as much as 3%.

In contrast to traditional markets, crypto markets remain much more fragmented, allowing managers to profit from spread opportunities with limited basis risk and leverage.

Vibrant Derivatives Market Creates Opportunities

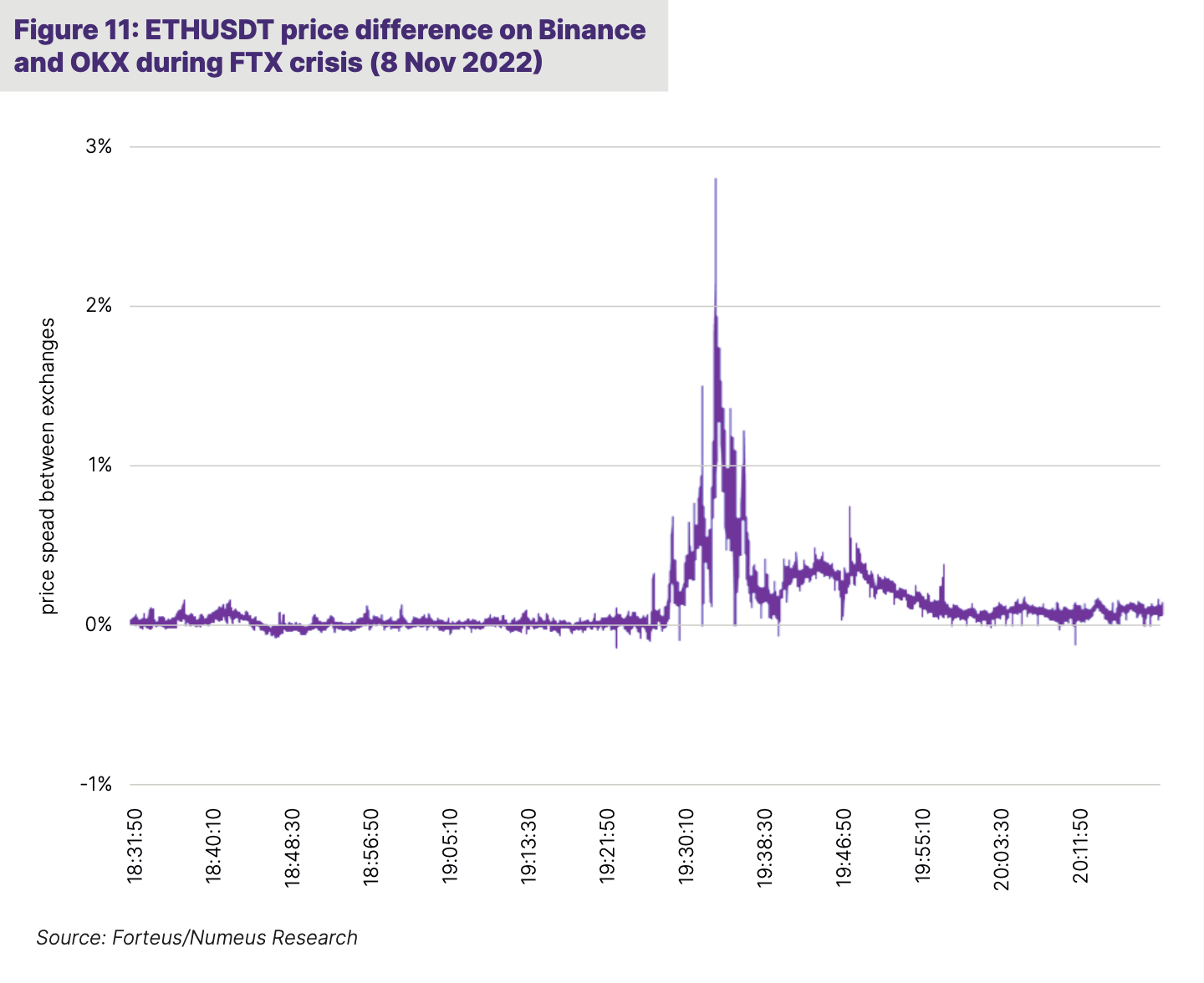

Crypto derivative products have been a significant area of innovation and growth, creating additional opportunities for traders. As of today, 65% of volumes in digital assets are traded through derivative products, principally futures and perpetual swaps. This has led to a thriving set of strategies focused on futures basis trading. The perpetual swap has created an entirely new set of yield and trading opportunities. The funding rate (or fee paid by holders of long contracts to those of short contracts, or vice versa, settling on a regular basis) is very much driven by retail demand for leverage and peaked during the 2021 bull market. At that time a simple market neutral position (long spot BTC vs. short BTC perpetual) generated in excess of 100% annualised return over a full month period (see figure 12 below).

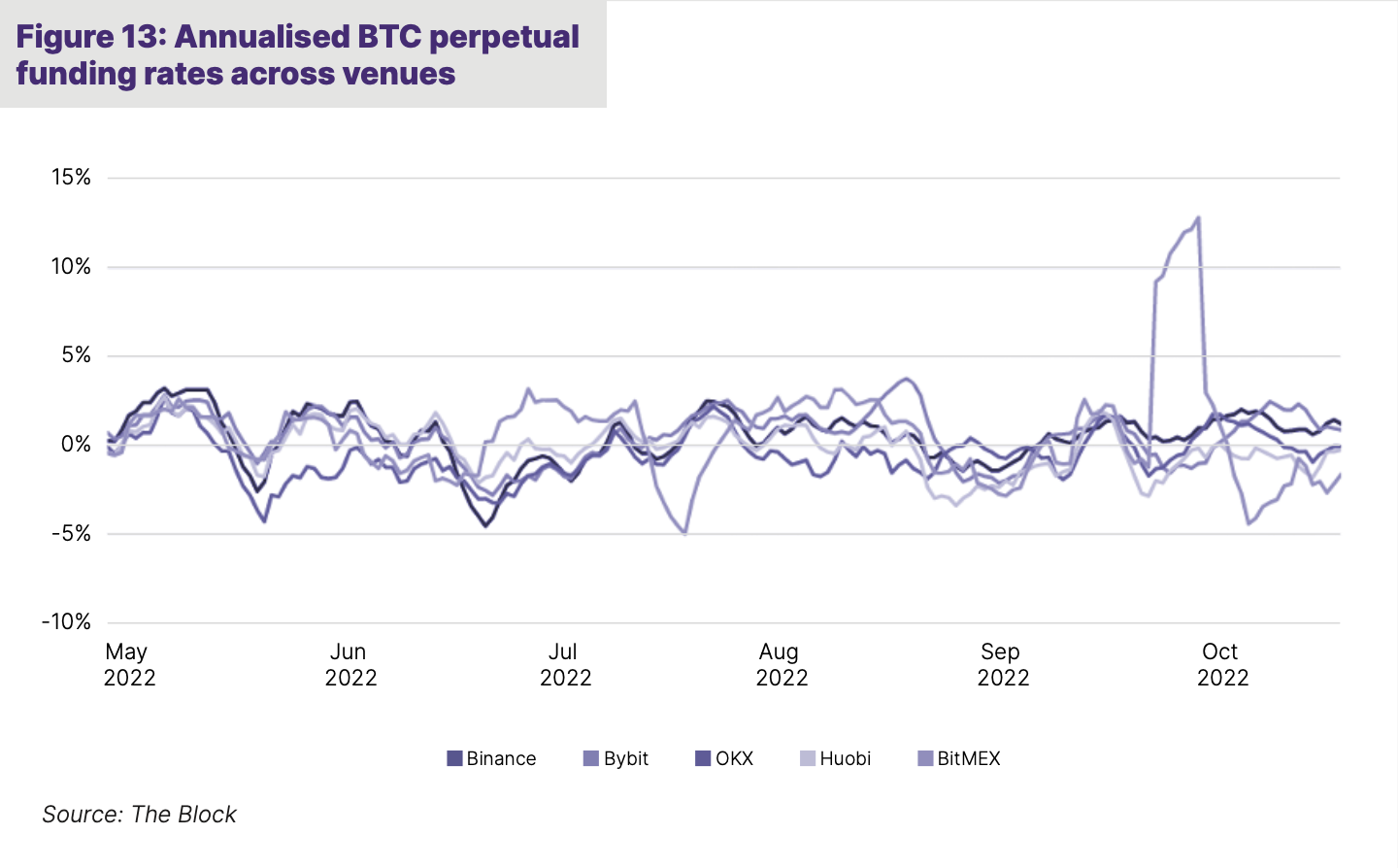

While these yields have inevitably compressed from the 2021 highs, the persistent volatility of these funding rates and divergence across venues (see figure 13 below) still allows for profitable market neutral trading strategies to be deployed across tokens.

The proliferation of derivative products on a wider number of tokens has also been beneficial both to statistical arbitrage and a range of complex arbitrage strategies. While often similar to traditional equity strategies, many opportunities are created in the digital asset space by a lack of consistent and accurate market data and by new datasets found on-chain that can be incorporated into trading models.

A History of Alpha Generation

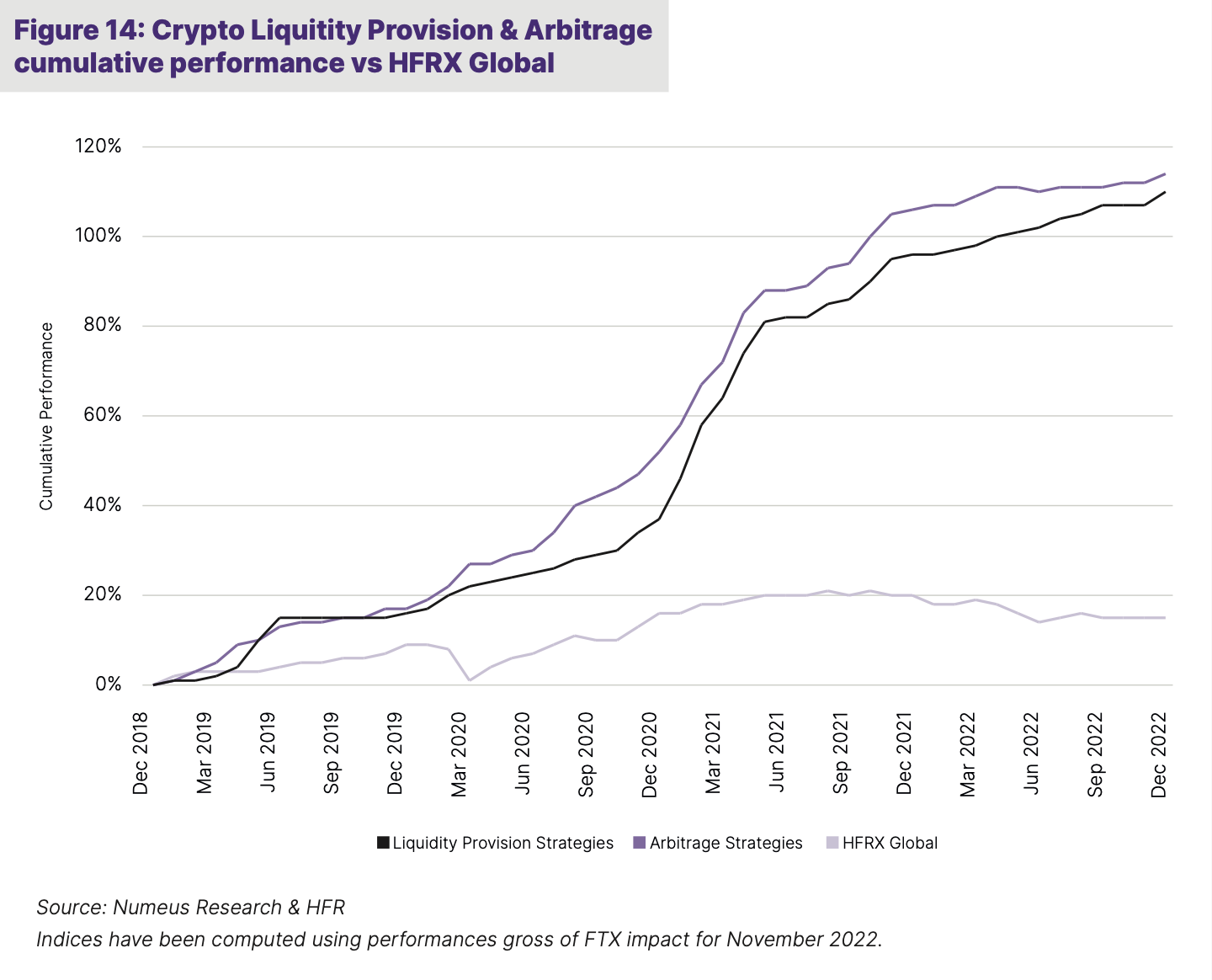

In order to evaluate the performance of non-directional crypto hedge funds with those of comparable traditional hedge fund strategies, we compare the historical performance of Arbitrage and Liquidity Provision strategies (represented by Forteus’ internal equal weighted hedge fund strategy indices, comprising 120 funds) with the HFRX Global Hedge Fund Index, which is an established standard benchmark for hedge fund performance.

Between December 2018 and December 2022, Arbitrage and Liquidity Provision strategies outperformed the HFRX Global index by 84% and 88% respectively (see figure 14 above). The bull market of 2021 was a prolific period for these managers as their strategies thrive on exuberant retail market participation, high volumes and high use of leverage. While 2022 was a more challenging year in the crypto market, with a prolonged bear market and some high profile collapses, it is important to note that both Liquidity Provision and Arbitrage managers continued to produce positive single-digit returns and outperform their traditional hedge fund peers.

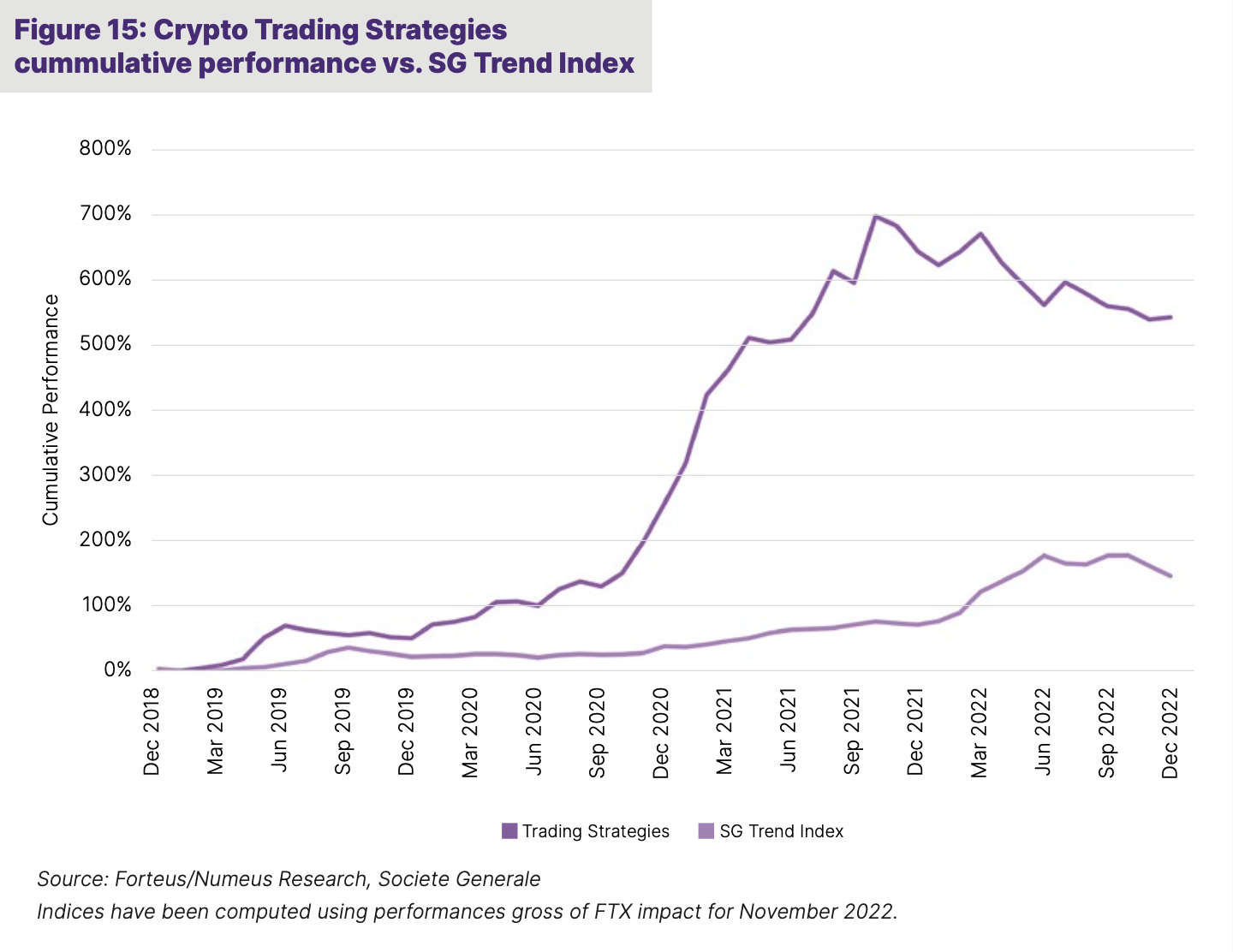

For crypto hedge funds that follow Trading strategies, we compare their performance against the SG Trend Index, which tracks the performance of traditional hedge funds that employ trend-following strategies.

Crypto trading strategies have significantly outperformed both traditional trend-following hedge funds and the broader market since 2019. In fact, the managers that we follow produced an annualised return of 71.3% over the period vs 25.5% for the SG Trend Index. These managers were able to capitalise on the high volatility in the crypto space and retain a large portion of the gains made during the crypto bull market rally (see figure 15 below).

A Challenging Trading Environment in 2022

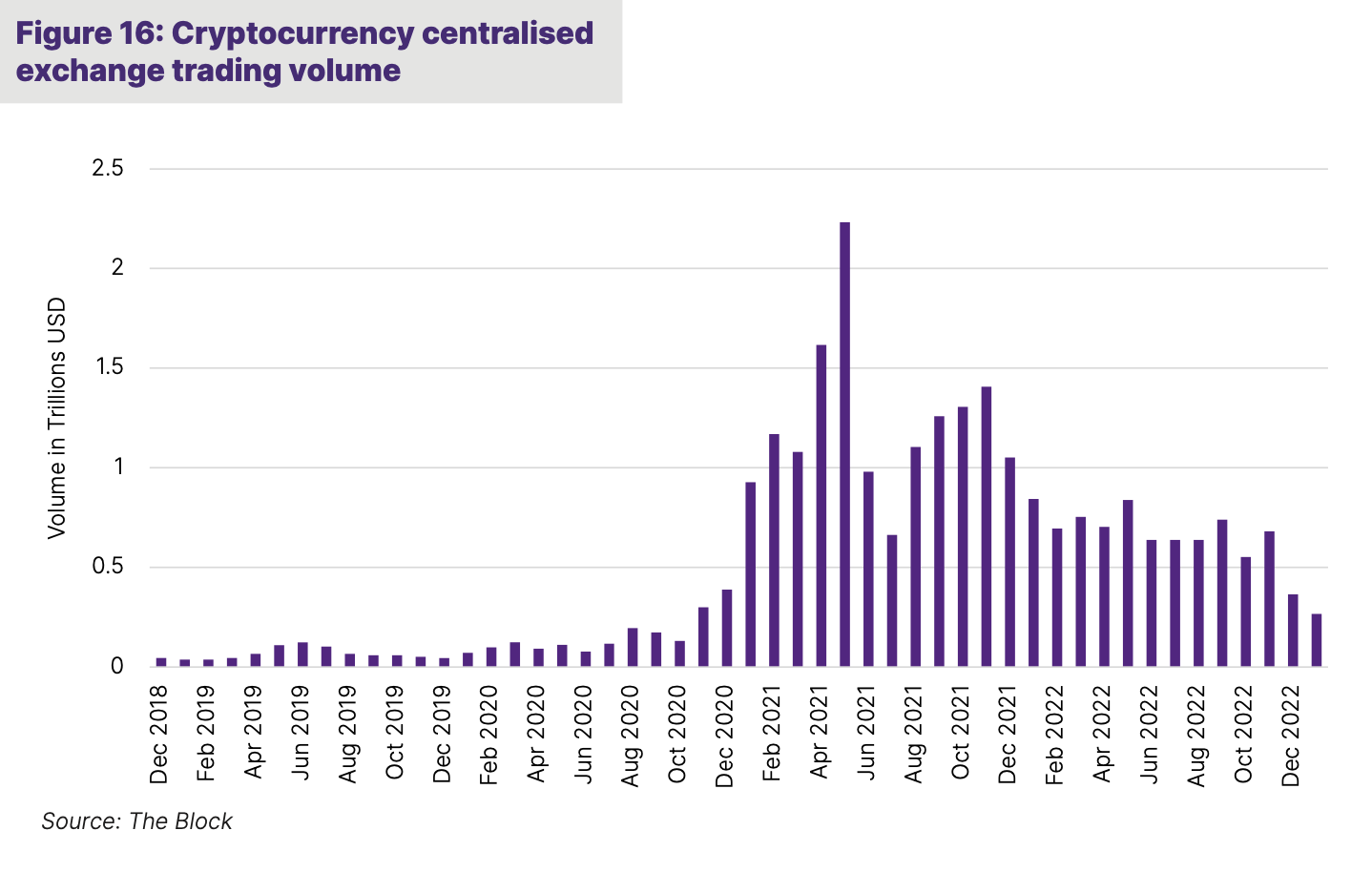

The bear market of 2022 brought several high profile crypto collapses (Terra/Luna, Celsius, 3AC and FTX) as well as a significant drop in retail volumes and liquidity across markets, as shown in figure 16.

Despite these setbacks, alpha-focused strategies were still able to generate positive returns for the year in 2022, with Liquidity Provision managers up 7.1% and Arbitrage strategies returning 4.2% (excluding impact from the collapse of FTX)1. While the overall FTX impact is still to be quantified, we estimate it to be sub 5% on average across the diverse sample of crypto hedge fund managers that we polled. Outcomes have ranged widely from no exposure (for structural reasons or thanks to swift risk management measures) to terminal events for certain funds which had over 25% FTX exposure. A number of players have been exiting the market since the collapse, benefiting those managers who followed stringent risk management practices and who are now in a position to profit from reduced competition.

Crypto Hedge Fund Risk and the Importance of Manager Selection

In order to fully harness the profits offered by digital asset markets, crypto hedge fund managers must also be aware of the risks.

In the case of many arbitrage strategies, for example, collateral management across multiple trading venues is essential. This requires dedicated infrastructure and monitoring tools to actively oversee complex portfolios with margin requirements. Managers will also look to avoid liquidation risks that could leave spread trades exposed to potentially significant losses. Unlike daily prime broker margin calls familiar to a traditional hedge fund manager, crypto managers operate on platforms that will typically liquidate positions systematically without prior notice if balances are not adjusted properly. This is a significant source of risk, but also a source of edge for managers who can build the necessary risk management tools.

Technology is vital to efficiently trade crypto markets. Although crypto fund managers are not locked in the same (expensive) arms race as their traditional counterparts, speed of execution, stability of connections and data processing remain key factors to take into consideration. We can also highlight the importance of optimal access and execution on DeFi platforms (introducing a new range of challenges such as the ones introduced by Miner Extractable Value (MEV) which we cover in a dedicated research piece here.

Finally, strong relationships within the crypto ecosystem play a particularly important role. A number of strategies for example benefit from being able to source, secure and lock in attractive borrow levels with the right crypto lenders.

As in any market, alpha progressively gets competed away and in the digital asset space, opportunities tend to evolve fast. It is therefore critical to identify the most competitive teams today but equally those that are set up to maintain their edge over time. This has been all the more visible during the current crypto bear market.

The Critical Role of Operational Due Diligence

The institutional adoption of digital assets, and the acceleration of this trend over the past two years, has meant there is an increasing need for institutional grade operational due diligence. This is particularly important since most institutional investors looking to gain exposure to digital assets do so via a fund.

Crypto funds have similar structures to their traditional counterparts and many of the battle-tested due diligence best practices from the traditional world can be applied here. However, cryptocurrencies and their related investment strategies create unique challenges for due diligence professionals. One such risk is the reliance on private keys to have custody over assets. Loss of a private key would prevent a fund’s access to their digital assets. Specialist technology is required to securely store a user’s private keys and fund managers can now draw on a range of solutions offered by specialist custodians such as Coinbase, Copper or Anchorage. Counterparty risk management is another area that requires special attention by any manager – and its importance has been magnified by the events of 2022.

Furthermore, we observe that some funds do not have dedicated COOs or equivalent, and also have limited segregation of duties because of lower staff count. Moreover, shadow NAV records are not always maintained to the same level as traditional hedge funds, and formalised policy documents and committees are not always in place. These are just a few examples that emphasise the importance of the due diligence process when it comes to manager selection in the digital asset ecosystem.

FTX, Counterparty Risk and the Way Forward

A lot has already been written about the demise of FTX, once the second largest crypto exchange in the world. We will not repeat that here, but will rather highlight a number of key takeaways as they relate to counterparty risk management (for a more detailed look at exchange counterparty risk, see our research report here:

• Centralised crypto exchanges play an important role in the crypto ecosystem. Despite the recent increase in market share by decentralised venues, centralised exchanges still account for more than 80% of volume.

• Building back trust in the crypto ecosystem and exchange community will require enhanced transparency from exchanges. The FTX event has accelerated this trend, with exchanges increasingly publishing their proof of reserves and submitting to audits by respectable external firms.

• Off-exchange settlement is becoming more common, with initiatives such as Binance’s mirroring functionality, Coinbase Prime’s cold storage trading option and Copper’s ClearLoop, allowing managers to reduce the amount of assets held in commingled wallets.

• In the future, the increased regulation of exchanges will also have an important role to play. One example that regulators may follow, is the one set by Japan where exchange operators are required to segregate customer accounts and maintain 95% of customer assets in cold storage.

• Crypto brokers are working on initiatives which would allow custody of assets to be segregated from execution, with collateral held in escrow by a third party. We favour this approach.

As we work towards a crypto market where exchange counterparty risk is fully segregated from custody, crypto fund managers can still take steps to mitigate it. Measures include diversifying the fund’s exposure across several exchanges, close monitoring of the risk profile of these trading venues, sweeping assets not required for immediate trading to custodial counterparties and making use of off-exchange settlement arrangements.

Conclusion

As institutions and experienced financial professionals have migrated into the crypto hedge fund industry in recent years, it has become difficult to ignore this new set of emerging managers, or indeed the similarities with the early days of traditional hedge funds and their potential for outsized returns.

Of course, with new opportunities comes a new set of challenges. Both investment and operational due diligence professionals must take care to properly navigate and assess the nuances of crypto markets and hedge funds, and draw on specific expertise when selecting the best portfolio managers.

While the crypto industry faced significant challenges during 2022, we believe that some important silver linings can be found. Improvements in infrastructure, risk management and regulation are accelerating, with measures such as off- exchange settlement becoming a necessity for traders. These should pave the way for larger institutional players to feel comfortable operating in the space.

We believe that crypto hedge funds continue to present an attractive investment opportunity for investors, one where an early- stage industry combines with rapid innovation and increasingly accomplished investment expertise to offer unique alpha capture opportunities. The past year has been a great reminder of the importance of both a deep understanding of the investment strategies available to managers, and a strong knowledge of the best practices of the ecosystem.

Forteus is the asset management arm of the Numeus Group, a global digital asset investment firm. For more information please visit the Forteus website or contact us at info@forteus.com.