Summary

Former US President Donald Trump will return to the White House after defeating Vice President Kamala Harris in the 2024 US election. This is the catalyst that the crypto industry has been waiting for, as the new administration is expected to push a much more constructive and collaborative regulatory agenda for digital assets in the US.

Trump has promised to make America the “crypto capital of the world”, which is expected to lead, over time, to greater innovation and institutional adoption of blockchain technology and crypto assets in the US. Banks and other traditional financial institutions are also likely to become more involved in crypto. Many of these firms have already started building digital asset capabilities behind the scenes, including trading, custody, and staking, in preparation for a more friendly regulatory environment.

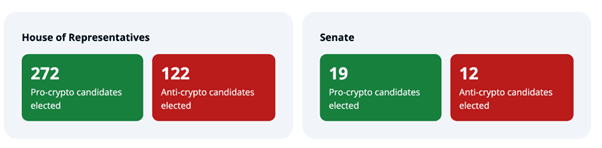

The incoming administration is surrounded by crypto supporters and is in an ideal position to push such an agenda. Republicans are expected to hold both the House and Senate, and around two thirds of congressional representatives elected in this cycle have a generally supportive stance towards crypto. We can expect plenty of noise and speculation as key positions are filled within Trump's cabinet, at the SEC and other regulatory bodies, and it will likely be well into 2025 before relevant policies can be meaningfully debated in Congress. But the general direction is clear, and a departure from the repressive approach to regulation in the US in recent years is a significant win for the industry.

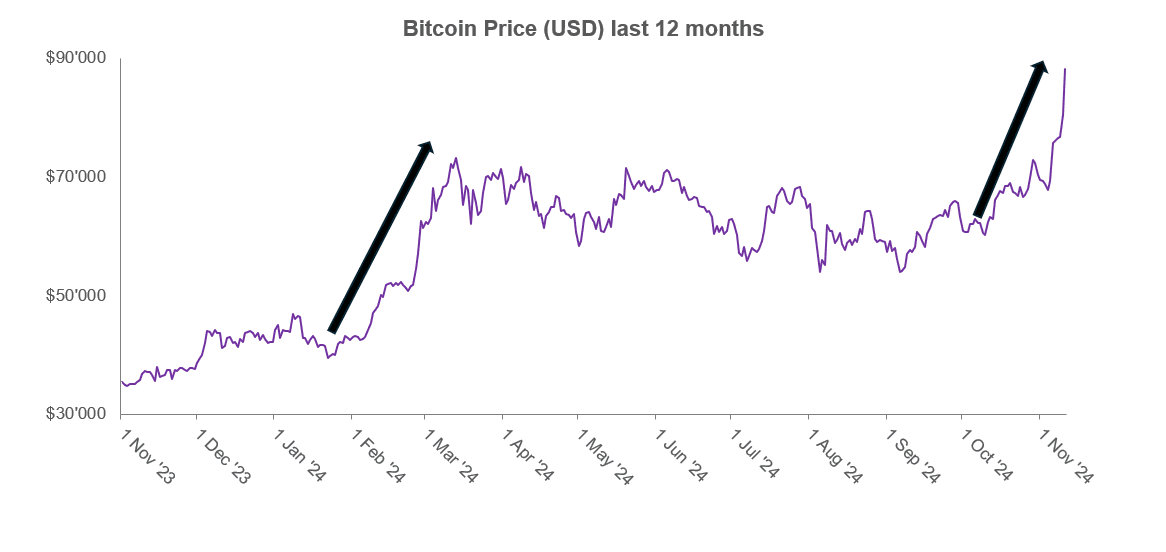

The election results have been the catalyst for Bitcoin prices to break out of the $55,000 to $75,000 range (in place since the end of Q1 2024), reaching an all-time-high of $90,000 in recent days (see below). Other digital assets have followed, as Altcoins arguably stand to gain even more from constructive regulations in the future.

Source: Coingecko

Source: Coingecko

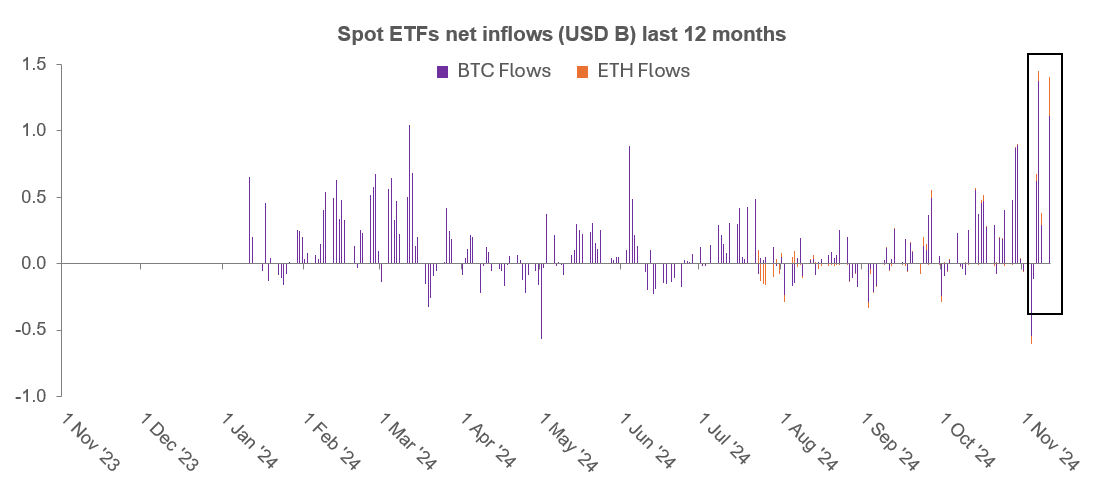

While the launch of the Bitcoin spot ETFs in the US in January ‘24 provided a more accessible instrument for institutional allocators to invest in crypto, the lack of regulatory clarity in the US has prevented much wider adoption by institutional investors and other market participants. In the few days since Trump’s victory, we have seen a strong uptick in market activity:

- Bitcoin spot ETFs recorded inflows of $1.4 billion last Thursday following the election result

- On Monday this week, Ethereum spot ETFs saw net inflows of $296 million - three times higher than their previous record day

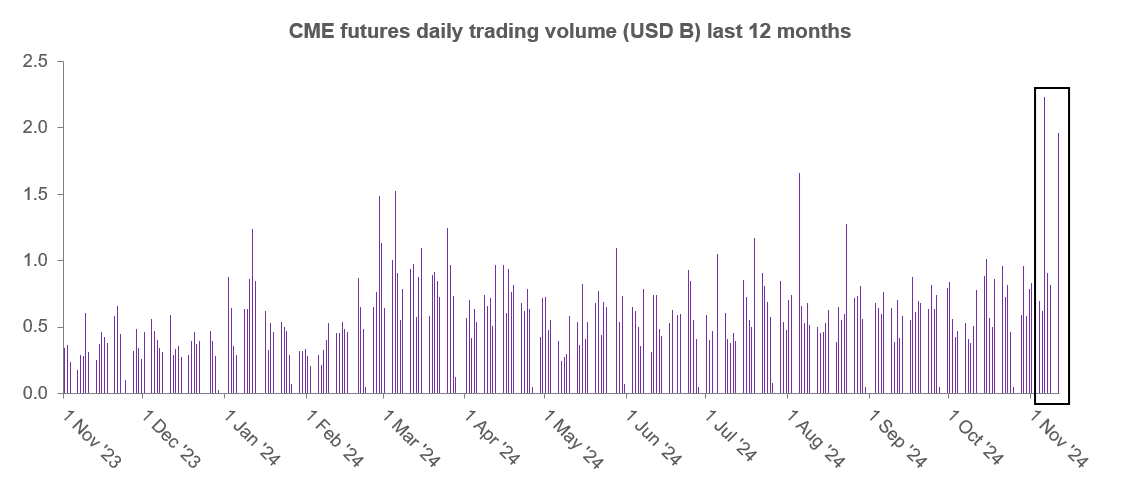

- CME Bitcoin futures trading volume has been hitting new record highs

Source: The Block and CME

Source: The Block and CME

The coming months and years are set to be transformative for the crypto industry. Below are details on the path toward a more supportive regulatory environment in the US, key issues to be addressed, and potential implications for the crypto industry and digital assets.

Trump’s Position on Crypto

While Trump has historically been a crypto sceptic, his stance changed materially in the run-up to election, including:

- Appointing a pro-crypto Vice President in JD Vance

- Speaking at the world’s largest Bitcoin conference in Nashville in July, laying out a vision for incorporating crypto into US economic and regulatory policy

- Launching his own crypto protocol, World Liberty Financial

- Conducting a Bitcoin transaction in the only “Bitcoin Bar” in the US

He had strong reasons to shift his rhetoric on digital assets, as it became clear that crypto was a key issue for younger voters, with Trump securing a larger proportion of the vote amongst under 30s than any Republican candidate since 2008. He also benefited in aligning with industry advocacy groups, which have spent much of the prior two years quietly building influence in Washington and raising funds for pro-crypto interests in the 2024 elections.

The Path to a More Supportive Regulatory Environment

Trump’s election victory comes after years of regulatory hostility towards crypto in the US, with a multitude of SEC lawsuits against exchanges including Coinbase, Kraken and Binance, as well as several crypto projects under investigation. The current “regulation by enforcement” approach has significantly hindered the growth of the crypto industry in the US, with many projects being developed abroad and over 90% of cryptocurrency trading taking place offshore.

Trump has stated that he wants the US to become a leader in the blockchain and crypto industries, and his administration will have the chance to reshape the way digital asset regulations are developed. In order to do so, productive collaboration between regulatory bodies and Congress will be key. Elements are lining up nicely to get to such a productive discussion.

Congress

The composition of Congress is critical, as it will determine the type and speed of implementation. Crypto’s biggest political lobbyists recognized this early, spending $135 million to support their favored candidates. These efforts were rewarded as the election has resulted in a much more supportive Congress. “Stand With Crypto”, a nonprofit advocacy organization, has ranked politicians on their stance towards crypto, based on their public statements, voting records and policy positions with respect to cryptocurrencies and blockchain technology. The outcome from the current Senate and House elections has been remarkable as can be seen below:

Source: www.standwithcrypto.org/races

Source: www.standwithcrypto.org/races

Finally, it is worth noting that Sherrod Brown of Ohio, who led the Senate Banking Committee and enforced the crypto crackdown Operation Chokepoint 2.0, has lost his Senate seat.

Regulatory Bodies

The SEC has been at the forefront of regulatory action against the crypto industry under the leadership of its chairperson, Gary Gensler. While the President does not have the power to explicitly remove the Chairman, history suggests that a change of leadership at the SEC will be almost inevitable. Since the election of President Clinton in 1992, all SEC Chairs have resigned before or shortly after the inauguration of a new President in the White House.

Speculation is already raging with regards to who might be next in line. With Howard Lutnick, the current CEO of Cantor Fitzgerald leading Trump’s transition team, many observers expect that crypto supporters will be appointed to key positions in his administration, including not only the SEC but also CFTC, the Treasury Department and the National Economic Council.

Executive Advisory Council

In addition to the traditional bodies, Trump also alluded in his speech at the Bitcoin Nashville conference in July to the creation of a Bitcoin and Crypto Presidential Advisory Council. Such a group would be tasked with designing transparent regulatory guidelines for the industry within the first 100 days of the new administration. While it will be well into 2025 before relevant policies can be debated in Congress, such an executive framework would give early insights into the direction it may take.

How regulatory clarity may take shape

While it is still too early to predict the exact impact on the crypto industry of clearer regulation in the US, we would expect a drip feed of positive news over the next 12 months, as new leaders within the regulatory bodies are appointed and digital assets are put on the legislative agenda.

This process promises to be noisy, but we can expect the outcome to be supportive of a multitude of use cases such as stablecoins for payments, ownership of digital content and data, in-game ownership, all of which require engagement from both legislators and regulators. This will foster innovation and VC capital deployment in the US, and ultimately can pave the way for further adoption of blockchains and crypto tokens.

Congress will have to develop a framework on how to classify and regulate crypto tokens as securities or commodities, a topic that has been addressed recently through the FIT 21 Bill. This will ultimately determine how these tokens can be used and clarify setups in which protocols can pass profits onto token holders, a topic that has been an ongoing discussion for profitable DeFi tokens such as Uniswap and AAVE.

Additionally, we expect regulation to lead to traditional US institutions entering or growing their crypto businesses in the US as the administration seeks to ensure US dominance of the industry. A simple step will be the repeal of SAB 121, the accounting rule which was implemented by a Presidential veto earlier this year, making it uneconomical for banks to custody 3rd party crypto assets. This would allow larger US banks to embrace the custody of digital assets. Over time, we expect US financial institutions to move from the beta-testing phase to more rapidly deploying blockchain technology and actively looking for commercial opportunities in the crypto ecosystem. Onshore exchanges are also likely to benefit from better regulation that have so far pushed all crypto derivatives trading offshore. Coinbase or Robinhood might be clear beneficiaries of such action and have seen substantial gains in their stock price since the close of Nov 4th (+74% and +35% respectively from Nov 4th to Nov 11th).

Generally, we are looking to see more corporate engagement, which has been stifled over the past few years. Web 2.0 and Wall Street incumbents who have been quietly building during the bear market are more likely to launch products. We would, for example, not be surprised to see Twitter integrate digital asset wallets and payment rails, as Telegram has done abroad. Meta has twice previously attempted to build a digital asset business only to be discouraged by the regulators. Such large retail brands re-entering the space would clearly be a catalyst for faster and larger scale adoption of blockchain tech and crypto assets.

The change in the regulatory environment could impact the market in other ways, including more new token listings on exchanges, more public equity listings, and more M&A in the crypto space. We may also see the proliferation of more institutional products (e.g. SOL ETF), as the SEC moves away from its very slow and restrictive policy on this matter.

Impact on Crypto Markets

Crypto markets have already been a clear beneficiary of the Republican sweep from last week’s election, leading to a re-assessment of ‘regulatory risk’ and significant price action in the last 7 days. As described above, Bitcoin has broken out of its 6 month range to reach new all-time highs and activity on CME and ETFs has been record breaking.

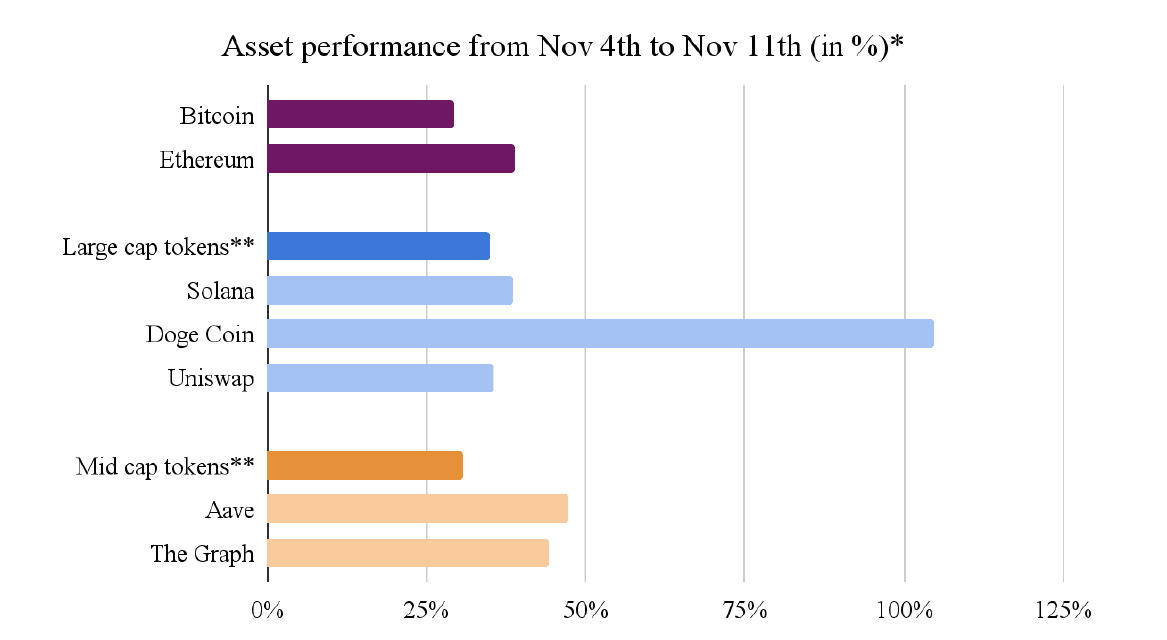

This trend is lifting all boats, with many large and mid-cap Altcoins performing in line with Bitcoin and Ethereum. There have been a few exceptions, such as certain Meme Coins which have done particularly well, perhaps as a result of associations with Elon Musk in the past:

Source: Coingecko. *4PM EST close **S&P Crypto Index of Large Caps (approx. top 40) excluding BTC and ETH and Broader Market Index (approx. top 300) excluding Large Caps

Source: Coingecko. *4PM EST close **S&P Crypto Index of Large Caps (approx. top 40) excluding BTC and ETH and Broader Market Index (approx. top 300) excluding Large Caps

As institutional investors chase the “Trump crypto trade” through ETFs and CME futures, Bitcoin and Ethereum are likely to benefit through continued inflows into ETFs. The Bitcoin ETFs have already been a beneficiary, with $4.2 billion of inflows in the first five days following the election. It will be interesting to see whether the Ethereum ETF will follow suit following months of underperformance. Strong inflows this week seem to indicate institutional investors could be warming up to the asset.

With the recent and clear breakout from longstanding trading ranges, we should expect more volatile markets in the weeks to come. As we look further ahead, increased regulatory clarity is most likely to benefit Altcoins. Indeed, Bitcoin so far has been the only token that has benefited from being clearly categorized as a commodity and not a security by the SEC. This process may take time, but ultimately we can expect strong performance from Altcoins that position themselves well in this new regulatory environment, and have built strong businesses.

Please reach out to any of the Forteus team members if you would like to discuss further or get in touch at investor.relations@forteus.com.